For anyone considering buying a property, it is important to understand the concept of an Option to Purchase (OTP). An OTP is a legal agreement between a buyer and a property owner that grants the buyer an exclusive right to purchase the property within a specified period of time and under agreed-upon terms.

What is an Option to Purchase (OTP)?

An OTP is a legally binding contract that outlines the terms and conditions for the purchase of a property. It includes details such as the purchase price, agreement period, and any other conditions that the parties involved may agree upon. It is typically prepared by a lawyer to ensure that the buyer’s interests are protected.

With an OTP, the buyer pays a nominal fee, known as the option fee, to the property owner. This fee grants the buyer the exclusive right to purchase the property within the agreed-upon timeframe. During this period, the owner cannot sell the property to anyone else.

Importance and Benefits of OTP

The OTP provides several benefits for both the buyer and the seller. Some key importance and benefits include:

- Protection for the parties involved: The OTP serves as a legally binding agreement that outlines the rights and obligations of both the buyer and the seller. It helps protect both parties from any potential disputes that may arise during the transaction.

- Flexibility for the buyer: The OTP allows the buyer to have exclusive rights to the property while they evaluate their options, secure financing, or complete any necessary due diligence.

- Security for the seller: The OTP provides the seller with a sense of security, knowing that the property is reserved exclusively for the buyer during the agreed-upon period. This can help prevent the seller from losing potential buyers while waiting for the buyer to make a decision.

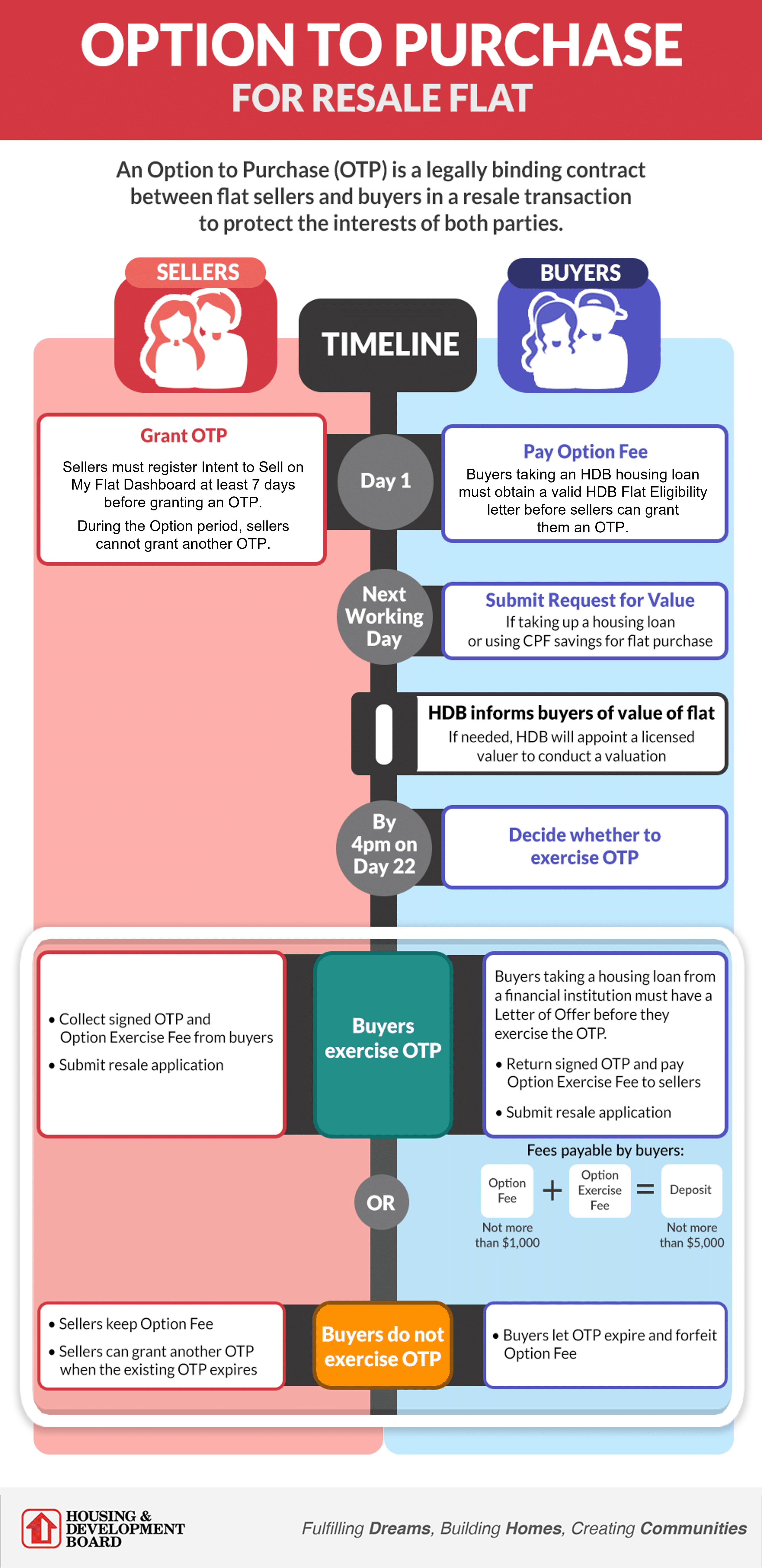

- Commonly used in resale flats: In certain countries, such as Singapore, the OTP is commonly used in transactions involving resale flats. The Housing and Development Board requires the use of an OTP to ensure that both buyers and sellers are protected and the transaction process is smooth.

In conclusion, an Option to Purchase (OTP) is an essential legal agreement in property transactions that provides protection and exclusive rights for the buyer while ensuring security for the seller. Understanding and utilizing an OTP can streamline the process and provide peace of mind for all parties involved.

Key Takeaways

- Definition of OTP: An Option to Purchase (OTP) is a legally binding agreement between a buyer and a property owner that grants the buyer an exclusive right to purchase the property within a specified period and under agreed-upon terms.

- Components of OTP: An OTP includes details like the purchase price, agreement period, and any other conditions agreed upon. It is typically prepared by a lawyer to protect the buyer’s interests.

- Option Fee: The buyer pays an option fee, which grants them exclusive rights to the property during the agreed-upon timeframe, preventing the owner from selling it to others.

- Benefits of OTP: OTP offers protection, flexibility, and security for both buyers and sellers. It safeguards their rights and obligations, allowing buyers time for due diligence.

- Common Usage: OTPs are frequently used in transactions involving resale flats, ensuring a smooth and protected process for buyers and sellers, especially in countries like Singapore.

- How OTP Works: OTP outlines terms like the purchase price, resale application steps, rights, option fee, buyer’s obligations, and the involvement of a lawyer in the process.

- Rights and Obligations: The OTP grants the buyer the right to purchase the property while obligating the seller to sell it at the agreed-upon price, with clear steps and conditions.

- Setting Purchase Price: Setting the purchase price is crucial, influenced by factors like loan affordability and the seller’s desired price.

- Expiry and Extension: OTPs have an expiry date, and provisions for extensions should be included for cases like securing financing or completing inspections.

- Executing OTP Agreement: Steps include negotiating and drafting the agreement, executing and registering it, arranging financing, and engaging lawyers to handle the legal aspects.

How does Option to Purchase (OTP) Work?

Defining the Terms and Conditions of the OTP

When it comes to purchasing a residential property, an Option to Purchase (OTP) can provide potential buyers with flexibility and security. The OTP is a legal agreement that allows the buyer to secure the exclusive right to purchase the property at an agreed-upon price within a specified period. It outlines various terms and conditions, including the price, prospective buyer, resales, resale application steps, rights, property agent involvement, option fee, buyer’s obligation to exercise the option, and engagement of a lawyer.

Understanding the Rights and Obligations of the Parties Involved

The OTP grants the buyer the right to purchase the property, while the seller is obligated to sell it at the agreed-upon price. During the option period, the buyer may conduct due diligence, including obtaining a bank loan and ensuring the property meets their requirements. Once the option is exercised by the buyer, a sale price is agreed upon, and a balance deposit, typically a percentage of the purchase price, is paid.

Negotiations can take place between the buyer and seller during this process, with any agreed-upon changes documented in an addendum to the OTP. The buyer then signs the OTP, and both parties engage their respective lawyers to prepare the necessary legal documentation. Upon completion of the transaction, the seller transfers ownership of the property to the buyer.

It is important for both parties to understand their rights and obligations throughout the process. The buyer should be aware of the potential financial risks, such as forfeiting the option fee if they choose not to exercise the option. The seller should ensure that the terms and conditions of the OTP protect their interests and outline any penalties for non-compliance.

Overall, an Option to Purchase (OTP) provides flexibility for potential buyers while allowing the seller to secure a committed buyer. It is essential for both parties to seek legal advice and fully understand the terms and conditions before engaging in an OTP agreement.

Key Considerations in Option to Purchase Agreements

Setting the Purchase Price

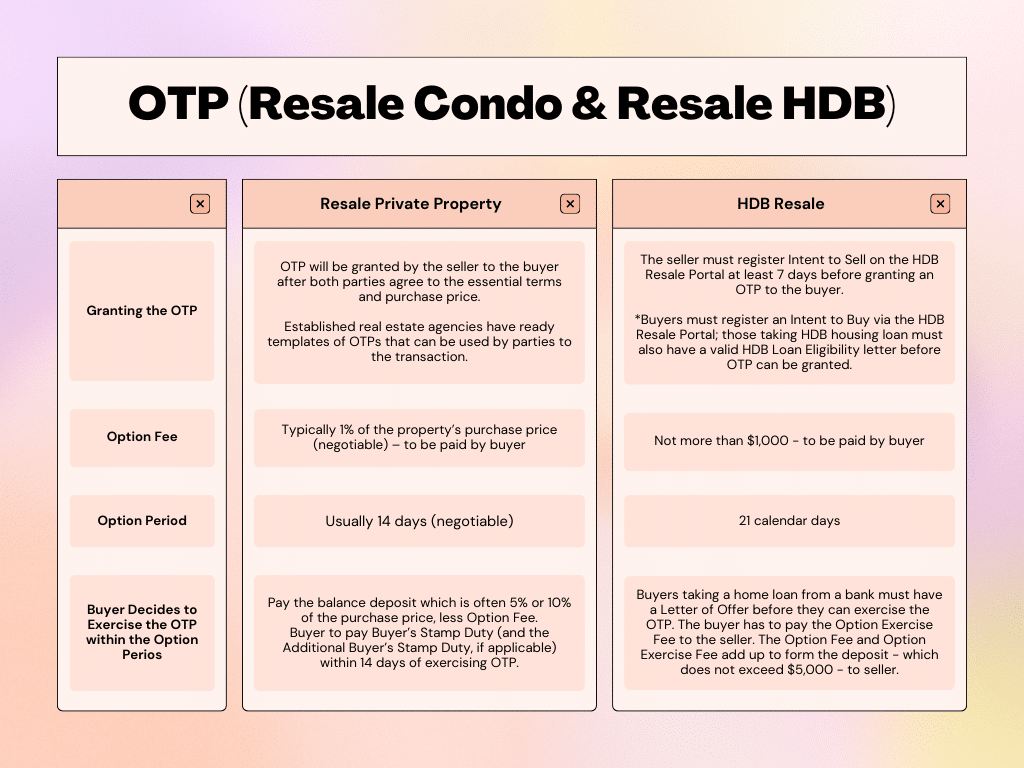

When entering into an Option to Purchase (OTP) agreement, setting the purchase price is a crucial consideration. During the option period, which typically lasts for a specific number of calendar days, the buyer has the right to purchase the property at a predetermined price. This price can be influenced by factors such as loan affordability, housing loan eligibility, and the seller’s desired selling price. It is important for both parties to negotiate and agree upon the purchase price before signing the OTP.

Expiry and Extension of the OTP

The OTP agreement specifies the duration of the option period and the date of expiry. If the buyer fails to exercise the option to purchase within the given timeframe, the OTP becomes void. However, in some cases, the buyer may require an extension of the option period due to various reasons, such as delays in securing a mortgage loan from a financial institution or the completion of necessary inspections. It is essential to include provisions in the OTP agreement that allow for such extensions, along with any related fees or rates that may be applicable.

During the option period, it is also common for the seller to provide vacant possession of the property to the buyer, along with an inventory list detailing the fixtures and fittings included in the sale. This allows the buyer to conduct a thorough inspection before proceeding with the purchase. The terms and conditions of the option should clearly specify the obligations of both parties regarding vacant possession and the inventory list.

In summary, when entering into an OTP agreement, both parties must carefully consider and negotiate the purchase price, as well as the expiry date and any potential extensions. Clear provisions should be included to address the issue of vacant possession and the inventory list. By taking these key considerations into account, buyers and sellers can ensure a smooth and successful transaction.

Steps Involved in Executing an Option to Purchase (OTP) Agreement

When it comes to property purchase decisions, buyers often encounter the term “Option to Purchase” (OTP). An OTP is a legal document that gives the potential buyer the exclusive right to purchase a property within a specified period of time. Here are the key steps involved in executing an OTP agreement.

Negotiating and Drafting the Agreement

In this step, the property market comes into play. Both the buyer and the property seller negotiate and agree on the key terms and conditions of the agreement. These may include the exact property, purchase price, payment terms, property taxes, and any other specific requirements. The buyer may engage a lawyer to draft the OTP agreement based on the agreed terms and conditions. It’s important to note that the conditions of sale in the agreement are usually negotiable, so both parties should take the time to review and discuss them thoroughly.

Execution and Registration of the OTP Agreement

Once the draft OTP agreement is finalized, the buyer and seller proceed with the execution of the agreement. The buyer usually pays an option fee, typically 1% of the purchase price, to secure the OTP. The OTP agreement is then registered with the relevant authority to ensure its legality and legitimacy.

During the specified period of time, which is typically 14 days, the buyer has the option to exercise the OTP by paying the remaining balance of the purchase price. However, buyers should be aware of the cooling-off period, as it allows them to rescind the agreement within three weeks without incurring any financial penalty or losing the option fee.

To complete the OTP process, the buyer must also arrange for the necessary financing, which involves determining the loan quantum and adhering to any loan restrictions set by the lender. Additionally, a completion date is agreed upon, and both parties may engage lawyers to handle the legal aspects of the transaction,

Rights and Responsibilities of the Option Holder and Option Grantor

Option Holder’s Rights and Duties

The Option to Purchase (OTP) is a legal agreement that grants the option holder the right to purchase a property within a specific period of time. As the option holder, it is important to understand your rights and duties in relation to the OTP.

First and foremost, the option holder is responsible for fulfilling the payment terms outlined in the OTP. This includes paying the option fee, which is usually non-refundable. The option holder must also ensure that the OTP is a binding contract and take any necessary legal steps to protect their interests.

In the event of a breach of contract by the option grantor, the option holder may have the right to seek legal remedies. It is important to have a clear understanding of the budget and financial implications of entering into an OTP.

Both parties should conduct themselves in a professional and ethical manner throughout the negotiations and execution of the OTP. It is advised to engage legal professionals and seek advice to ensure all legal documents are properly prepared and executed.

During the option period, the option holder has the right to conduct due diligence on the property. This includes inspections, obtaining necessary permits, and conducting any necessary research related to the property.

Option Grantor’s Rights and Obligations

The option grantor, on the other hand, has their own set of rights and obligations. It is common for the option grantor to engage a law firm to assist in the negotiation and preparation of the OTP. This can be a lengthy process, and both parties should be patient and willing to negotiate in good faith.

The option grantor must provide accurate and complete information about the property to the option holder. This includes disclosing any encumbrances or legal issues that may affect the property.

In the event of a tight spot such as a financial difficulty, the option grantor should communicate openly with the option holder and discuss possible solutions. It is important for the option grantor to adhere to the agreed-upon payment schedule and exercise financial discipline.

If the option grantor wishes to tailor the terms of the OTP, it is essential to discuss and negotiate these changes with the option holder. Both parties must come to a mutual agreement on any changes to the original terms of the OTP.

Ultimately, the rights and responsibilities of the option holder and option grantor should be clearly outlined in the OTP to avoid any misunderstandings or disputes. Seeking legal advice and conducting thorough research can help ensure a smooth and successful transaction in real estate.

Common Issues and Challenges in Option to Purchase (OTP) Transactions

Disputes and Breach of Contract

When it comes to Option to Purchase (OTP) transactions, there can be various issues and challenges that may arise, leading to disputes and breach of contract. Some of the common problems include:

- Transfer of title: Ensuring a smooth transfer of title can be a complex process, especially if there are outstanding encumbrances or legal implications involved.

- Certificate of numbering issued: If the certificate of numbering is not issued correctly or if there are discrepancies, it can cause delays and complications in completing the transaction.

- Public holidays: Public holidays can disrupt the timeline of an OTP transaction, leading to misunderstandings or missed deadlines.

- Title deeds: Verifying the authenticity and accuracy of title deeds is crucial to avoid any legal complications or misunderstandings between the parties involved.

- Standard Option vs. special conditions: The terms and conditions stated in the OTP contract can sometimes be open to interpretation or may not be specific enough to address unique situations, leading to disagreements.

- Forfeit and negotiation: If one party fails to fulfill the conditions specified in the OTP agreement, such as non-payment or failure to complete the transaction, negotiations or legal actions may be required.

To resolve disputes in OTP agreements, several steps can be taken:

How to Resolve Disputes in OTP Agreements

- Additional sale: Parties can consider negotiating or renegotiating terms to reach an agreement that satisfies both sides.

- Legal checks: Carrying out thorough legal checks and due diligence before entering into an OTP transaction can help identify potential issues and reduce the risk of disputes.

- Eligibility letter: Obtaining an eligibility letter from the relevant authorities is crucial, especially for non-residential property purchases, to ensure compliance with regulations.

- Accurate property address: Ensuring the property address is accurately stated in the OTP agreement is essential to avoid any confusion or misunderstandings.

- Parties must agreeable: Both parties involved must be willing to discuss and negotiate any disputes that arise during the OTP transaction process.

- Seek legal advice: If disputes cannot be resolved through negotiation, seeking legal advice and involving a mediator or arbitrator may be necessary to reach a resolution.

By addressing these common issues and challenges in OTP transactions and taking proactive measures to resolve disputes, buyers and sellers can minimize the risk of breach of contract and ensure a smooth and successful transaction.

Advantages and Disadvantages of Option to Purchase (OTP)

Advantages of Option to Purchase (OTP)

When it comes to property transactions, an Option to Purchase (OTP) offers several advantages for both buyers and sellers. Here are some of the key benefits:

- Protection for defects: An OTP allows the buyer to inspect the property and identify any defects before committing to the purchase. This protects the buyer from unexpected repair costs later on.

- Property in excess: If the property has a larger area than stated in the Option, the buyer has the right to purchase the excess area at a predetermined price. This ensures that the buyer gets what they are paying for.

- Flexibility in property transactions: With an OTP, the buyer has the flexibility to exercise their right to buy within the specified validity period. This gives them time to assess the property and secure financing.

- Address of property: The OTP must clearly state the address of the property, ensuring that both parties are aware of the exact location.

- Claims on property: The buyer can protect their interest in the property during the validity period of the OTP, preventing the seller from selling it to someone else.

- Condition of property: The OTP should include details about the condition of the property, giving the buyer a clear understanding of what they are purchasing.

- Conveyancing Lawyers for Singapore Property Transactions: Engaging a conveyancing lawyer can help ensure that the OTP is legally watertight and protects the interests of both the buyer and the seller.

Drawbacks and Limitations of Option to Purchase (OTP)

While an OTP offers advantages, there are also some limitations and drawbacks to consider:

- 7-day cooling-off period: Once the OTP is exercised, there is a 7-day cooling-off period during which the buyer can withdraw from the transaction without any penalty.

- Completion period: The completion period, or the time between exercising the OTP and completing the purchase, is typically 8 to 10 weeks. This may not suit buyers who need to move in quickly.

- Validity period: The OTP has a specific validity period within which the buyer must exercise their option. If the option expires, the buyer loses their right to purchase the property.

- Defects liability period: After completion, the buyer has a limited timeframe, usually 12 months, to report any defects in the property for the seller to rectify.

- Exercising an option to purchase: The buyer must carefully follow the terms and conditions stated in the OTP when exercising their option to purchase to ensure a smooth transaction.

- Whether the property is sold: If the property is sold to a third party during the validity period of the OTP, the buyer loses their right to purchase.

- Buyers must act within a specified time: Buyers need to be aware of the timeline stated in the OTP and act promptly to avoid missing important deadlines.

Benefits of Exercising an Option to Purchase

Securing the right to purchase a property at a predetermined price

By exercising an Option to Purchase (OTP), buyers have the exclusive right to purchase a property at a predetermined price within a specified period of time. This protects the buyer’s interest as it prevents the seller from selling the property to someone else during this time. Only eligible buyers, such as Singapore citizens, permanent residents, or eligible home buyers under certain schemes, are allowed to enter into an Agreement Buyer’s OTP. In the event of any breach of the agreement by either party, there may be penalties involved.

Time to arrange financing and conduct due diligence

Exercising an OTP gives buyers additional time to arrange for financing and conduct due diligence on the property. This is especially important for resale HDB flats, where buyers need to obtain a HDB loan approval letter before completing the purchase. The key terms, such as the purchase price, completion date, and other essential terms, will be stated in the OTP, making it a legally binding agreement. Buyers can engage a conveyancing lawyer to check the OTP and tailor any specific clauses required.

During this period, buyers can engage in thorough inspection of the property and seek advice from their conveyancing lawyer to ensure that all legal requirements are met. This allows buyers to make an informed decision before finalizing the purchase. The buyer will usually pay a small option fee, which will be credited towards the purchase price upon completion of the transaction.

In conclusion, exercising an Option to Purchase provides several benefits to buyers. It secures the right to purchase the property at a predetermined price, allowing buyers to negotiate and finalize the purchase without the risk of losing the property to other buyers. It also provides the necessary time to arrange financing and conduct due diligence, ensuring that buyers can make an informed decision before committing to the purchase.

Conclusion

When it comes to the Option to Purchase (OTP) agreement, both buyers and sellers need to proceed with caution and ensure they have proper legal representation. The seller should consult with their lawyer to determine the reserve price and any other terms they wish to include in the agreement. The buyer, on the other hand, must carefully review the property’s details and do their due diligence before deciding to exercise the option.

It is crucial to understand that the OTP agreement is a legally binding contract. During the option period, the buyer will pay an option fee to the seller, giving them the exclusive right to buy the property within a specified time frame. Once the buyer decides to exercise the option, they must sign the acceptance copy and proceed with the purchase according to the agreed terms.

Experienced conveyancing lawyers play a vital role in guiding both parties through this process and ensuring that all legal requirements and conditions are met. They can assist in drafting the purchase contract based on the terms agreed upon and help protect their clients’ interests.

As a buyer or seller, it is essential to share sensitive information related to the property only through official and secure websites. Avoid using unsecure platforms such as Yahoo or other non-official channels. This added precaution will prevent any unauthorized access to your confidential data.

Both buyers and sellers should take sufficient time to review and understand the terms and conditions of the OTP agreement. In case of any doubts or concerns, seeking counsel from a lawyer is always advisable. Lawyers can provide expert advice and ensure that both parties comply with all contractual obligations.

In conclusion, the Option to Purchase (OTP) agreement is a significant step in the process of buying or selling a property. Both parties should approach it with care and seek legal assistance to protect their interests and ensure a smooth transaction. By having experienced conveyancing lawyers involved and following proper procedures, buyers and sellers can navigate the OTP process successfully and securely.

Remember, buying or selling a property is a significant financial decision, and it is crucial to make informed choices based on legal advice and due diligence.