As Singapore’s property market continues to be a hot topic, authorities are looking for ways to cool down the overheated sector. Recent reports suggest that the government is planning to introduce new cooling measures in 2023, following several previous attempts to curb property speculation. These measures will likely affect different aspects of the property market, from stamp duties and loan-to-value ratios to overseas buyers and developers. In this blog post, we’ll take a closer look at what the new cooling measures could entail and what their potential impact could be on Singapore’s ever-evolving property landscape.

Revised ABSD Rates to Apply from Apr 27, 2023

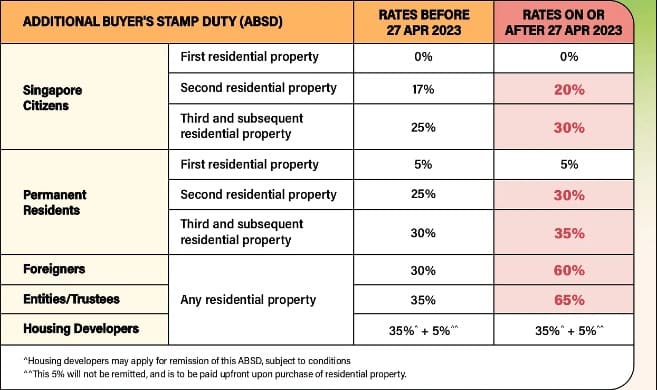

Starting from April 27, 2023, there will be a revision of ABSD rates for all residential properties acquired in Singapore. Singaporeans purchasing their second residential property will now have to pay a higher ABSD of 20%, instead of the current rate of 17%. For third and subsequent residential properties, the rate will be increased from 25% to 30%. The revised ABSD rates are expected to moderate demand in the property market, especially for those looking to purchase multiple properties. The transitional provision in place will ensure a smooth transition for those who have already committed to buying residential properties. These measures are part of the government’s efforts to encourage sustainable growth in the property market and ensure affordable housing for all. Besides, foreign buyers will also be required to pay a higher ABSD rate of 60% when purchasing residential property from the same date.

Implementation of New Cooling Measures in Sept 2022

In September 2022, the Singapore Government implemented a new round of property cooling measures to curb demand and borrowing. This came on the heels of the previous measures in December 2021, which had a moderating effect on the hot property market. The main objective of the latest measures is to dampen borrowing by homeowners and to control demand from private property owners. Singapore’s property market has been facing a rising trend of property prices and transaction volumes, prompting the introduction of these measures. While it remains to be seen how effective these measures will be in the long term, they are expected to help moderate the market and create a more stable environment for both buyers and sellers.

BSD Rates and ABSD Increase to Moderate Demand

The Singapore government has announced an increase in Buyer’s Stamp Duty (BSD) rates and Additional Buyer’s Stamp Duty (ABSD) rates to moderate demand in the property market. This move is part of a series of cooling measures that the government has been implementing over the past two years to maintain stability in the market. From April 27, 2023, BSD rates for residential properties costing over S$2 million will be raised to 5%, while the ABSD rate for Singapore citizens buying their second residential property will be raised from 17% to 20%. This increase in ABSD rates will affect about 10% of residential property transactions. The government hopes that these measures will help to moderate demand and prevent further speculation in the market while ensuring that home prices remain affordable for Singaporeans.

Another Round of Cooling Measures Implemented in 2022

The Singapore government has been taking measures to curb the property market, and in 2022, another round of cooling measures was implemented. These measures were put in place to help moderate housing demands and prevent the property market from overheating. The previous set of cooling measures was implemented in December 2021, which shows how seriously the government is taking this issue. The new measures include an increase in BSD rates and ABSD, which will likely discourage speculation in the property market. With these measures in place, Singaporeans can expect a more sustainable property market moving forward.

Foreigners to Pay Additional Buyer’s Stamp Duty (ABSD) from Apr 27, 2023

In a bid to moderate demand in Singapore’s property market, the government has announced that foreigners will have to pay higher Additional Buyer’s Stamp Duty (ABSD) rates from April 27, 2023. The ABSD rate for foreigners purchasing any residential property will increase from 30 to 60 percent. This is in addition to the higher rates already announced for Singapore citizens and permanent residents purchasing their second and subsequent properties. While these measures may deter some foreign investors, it is important to note that Singapore remains an attractive destination for real estate investment due to its stable political environment, strong economic fundamentals, and strategic location.

Two Rounds of Cooling Measures Introduced Over the Last 2 Years

Over the past two years, Singapore has introduced two rounds of cooling measures aimed at stabilizing the property market. The first round, implemented in 2021, focused on increasing taxes and fees for property purchases, while the second round, which was introduced in 2022, aimed at moderating demand and promoting prudent borrowing. These measures were put in place to prevent the property market from overheating and ensure that prices remain affordable for Singaporean households. Although the measures have had some success in tempering price growth, experts are still cautious about the long-term effects they may have on the market.

Permanent Residents to Face Higher ABSD Rates for Second Residential Property

In the latest update of Singapore’s property market cooling measures for 2023, permanent residents looking to purchase their second residential property will be facing higher ABSD rates. The ABSD rate has increased from 15% to 25%, which means they will have to pay an additional 10% on their purchase compared to the previous rate. This move is aimed at moderating demand in the property market and ensuring that Singapore’s housing supply is reserved for citizens who need it the most. This policy is part of a comprehensive package of measures that the government has introduced to cool the residential property market, which includes revised ABSD rates, implementation of new cooling measures, and BSD rate increases. These measures are in response to the rising property prices observed over the last few years, and the government hopes that they will contribute to a more stable and sustainable property market in Singapore.