Embarking on the homeownership journey demands mastering a mortgage affordability calculator—a delicate dance between your income, expenses, and financial factors.

Imagine an “affordability calculator,” a guide that deciphers complexities.

It reveals the impact of interest rates, loan terms, and property costs, enabling you to sculpt your ideal mortgage.

With this calculator’s power, you’ll transform uncertainties into clear choices.

Picture a future where property taxes, stamp duties, and loan durations are no longer a puzzle.

This guide empowers you to weigh, anticipate, and allocate wisely.

By the journey’s end, you’ll own not just a home but a sanctuary shaped by your aspirations and illuminated by insight.

Welcome to the world of mortgage affordability—where dreams meet reality with finesse.

Key Takeaways

- Mortgage Affordability Definition: Mortgage affordability refers to the mortgage loan amount you can manage based on your income, expenses, down payment, and financial commitments.

- Determining Factors: Multiple factors influence mortgage affordability, including income, existing debts, credit score, interest rate, loan tenure, and down payment.

- Importance of Understanding: Knowing your mortgage affordability helps set realistic home-buying expectations, prevents financial strain, and aids in effective budget planning.

- Affordability Calculator: An affordability calculator estimates how much you can borrow for a mortgage. It considers income, expenses, and down payment to determine your affordability.

- Debt-to-Income Ratio: The debt-to-income ratio (DTI) compares your monthly debt payments to your gross income. Lower DTI ratios enhance loan approval chances.

- Budget Planning with Calculator: An affordability calculator assists in budget planning by estimating monthly mortgage payments, helping you allocate funds for other expenses.

- Loan Tenure Impact: Shorter loan terms lead to higher monthly payments but lower overall interest paid. Longer terms offer lower monthly payments but higher interest costs.

- Property Taxes and Costs: Property taxes and recurring expenses impact mortgage affordability. Use the calculator to estimate these costs and adjust your budget.

- Interest Rate Analysis: Interest rates significantly affect affordability. The calculator helps compare different rates, allowing you to select the best option.

- Loan Term Selection: Loan terms influence monthly payments and total costs. Use the calculator to assess various terms for the best affordability fit.

Understanding Mortgage Affordability

How does mortgage affordability work?

Mortgage affordability refers to the amount of mortgage loan you can afford based on your monthly income and expenses.

It considers your monthly income, down payment, interest rate, loan tenure, and other financial commitments.

What factors determine mortgage affordability?

Several factors contribute to your mortgage affordability.

These include your monthly income, debts, credit score, interest rate, loan tenure, and the amount you can put toward a down payment.

Lenders assess these factors to determine how much they will lend you.

Why is it important to understand mortgage affordability?

Understanding your mortgage affordability is crucial for several reasons:

- It helps you set realistic expectations when searching for a home. Knowing your affordability allows you to narrow your choices to properties within your budget.

- It prevents you from overstretching your finances and getting into a situation where you need help to meet your monthly mortgage payments.

- It lets you plan your budget effectively, ensuring you allocate funds for other expenses while comfortably affording your mortgage.

Exploring the Role of an Affordability Calculator

What is an affordability calculator?

An affordability calculator is a tool that helps you estimate how much you can afford to borrow for a mortgage.

It considers your monthly income, expenses, down payment, and other relevant financial information to assess your affordability.

How does an affordability calculator work?

An affordability calculator uses complex algorithms to analyze your financial information and calculate the maximum mortgage amount you can afford.

It considers factors such as your monthly income, existing debts, interest rates, and loan tenure to provide you with an estimate.

What information is required to use an affordability calculator?

To use an affordability calculator, you must provide information such as your monthly income, existing debts, down payment amount, and interest rate.

This information helps the calculator determine your affordability and gives you an estimate of the mortgage loan amount you can afford.

Calculating Your Monthly Debt-to-Income Ratio

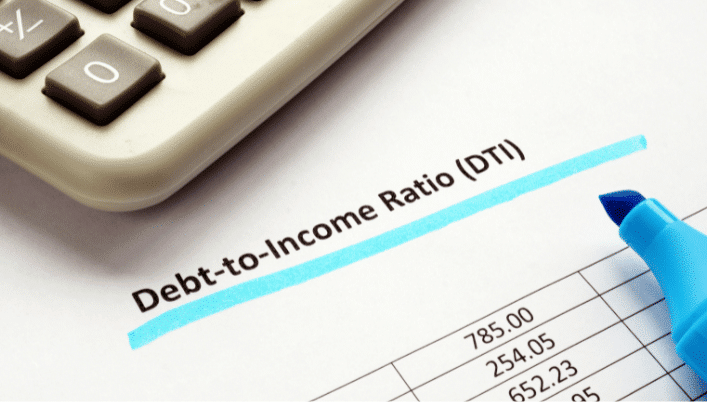

What is the debt-to-income ratio?

The debt-to-income (DTI) ratio is a financial metric that compares your monthly debt payments to your gross monthly income.

It is calculated by dividing your total monthly debts by your gross monthly income and multiplying the result by 100 to get a percentage.

How to calculate the debt-to-income ratio?

Add all your monthly debt payments, including credit cards, student loans, and other loans, to calculate your debt-to-income ratio.

Then, divide this total by your gross monthly income.

The resulting percentage is your debt-to-income ratio.

What is considered a good debt-to-income ratio?

A good debt-to-income ratio is generally below 36%.

Lenders use this ratio to assess your ability to meet your monthly mortgage payments.

A lower debt-to-income ratio indicates a lower risk for lenders and increases the likelihood of loan approval.

Utilizing the Affordability Calculator for Home Loans

How can an affordability calculator help with home loans?

An affordability calculator is an essential tool in the home loan process.

It allows you to assess your affordability before approaching lenders or real estate agents.

Using an affordability calculator, you can determine your budget and search for properties within your price range.

What are the benefits of using an affordability calculator?

Using an affordability calculator offers several benefits:

- It saves you time and effort by providing you with an estimate of your affordability. This allows you to save time looking at properties within your budget.

- It helps you make informed financial decisions by giving a clear picture of the mortgage loan amount you can comfortably afford.

- It allows you to compare different scenarios by adjusting variables such as interest rates and down payment amounts to find the most suitable mortgage option.

How can an affordability calculator help in budget planning?

An affordability calculator plays a crucial role in budget planning.

It helps you understand how much of your monthly income will be allocated toward your mortgage payment.

Knowing your monthly mortgage commitment allows you to plan your budget effectively and make provisions for other expenses such as utilities, insurance, and savings.

Factors Affecting Monthly Affordability in Singapore

What are the key factors influencing monthly affordability in Singapore?

In Singapore, several factors impact monthly affordability.

Significant factors include property prices, mortgage rates, and the borrower’s income.

Additionally, the buyer’s existing debts, loan tenure, and down payment amount also play a role in determining affordability.

How do property prices impact affordability in Singapore?

High property prices in Singapore can make it challenging for buyers to afford a home.

Buyers may need more significant loan amounts as property prices increase, resulting in higher monthly mortgage payments.

This can affect the overall affordability of purchasing a property in Singapore.

What are the current mortgage rates in Singapore?

The current mortgage rates in Singapore vary depending on market conditions and the type of loan.

Buyers must stay updated with the latest rates to determine their affordability accurately.

Consulting with a mortgage specialist or using an affordability calculator can help assess the impact of interest rates on monthly payments.

Analyzing Your Monthly Income for Mortgage Budgeting

Understanding your income sources

When assessing your affordability, it’s crucial to understand your income sources comprehensively.

This includes your regular salary and any additional income, such as bonuses, commissions, or rental income from other properties.

By considering your income sources, you can get a more accurate picture of your financial capabilities.

Calculating your gross monthly income

To determine your affordability, it’s essential to calculate your gross monthly income.

This figure represents your income before deductions, such as taxes or loan repayments.

By calculating your gross monthly income, you can assess how much money you have available for mortgage payments.

Considering variable income and future changes

It’s also crucial to consider any variable income or future changes that may impact your financial stability.

For example, if you are self-employed or work on a commission basis, your payment may fluctuate monthly.

Additionally, consider any potential changes in your income, such as raises or promotions, as well as any upcoming significant expenses or financial commitments.

Managing Monthly Debt Obligations for Loan Approval

Evaluating existing debt payments

When assessing your affordability, evaluating your existing debt payments is essential.

This includes outstanding loans, credit card debt, or other financial obligations.

By considering your debt payments, you can determine how much additional debt you can comfortably manage without overextending yourself financially.

Calculating your debt-to-income ratio

Your debt-to-income (DTI) ratio is a critical factor that lenders consider when determining your loan approval.

It measures the percentage of your monthly income that goes toward debt payments.

To calculate your DTI ratio, divide your total monthly debt payments by your gross monthly income and multiply by 100.

Strategies to improve your DTI ratio

If your DTI ratio is too high, it may impact your loan eligibility.

To improve your DTI ratio, consider strategies such as paying off outstanding debts, consolidating loans, or increasing your income.

Reducing your debt obligations can increase your affordability and improve your chances of obtaining loan approval.

Determining Loan Eligibility Based on Monthly Income

Estimating your maximum loan amount

Once you clearly understand your monthly income and debt obligations, you can estimate your maximum loan amount.

This amount represents the sum you can borrow based on your income and affordability.

It’s important to remember that this is just an estimate and may vary depending on factors such as interest rates and loan terms.

Understanding loan-to-income ratio

The loan-to-income ratio is another essential factor when determining your loan eligibility.

It measures the percentage of your monthly income that goes toward mortgage payments.

Lenders typically have specific requirements for the loan-to-income ratio, and exceeding these limits may affect your loan approval.

The impact of interest rates on your loan eligibility

Interest rates play a significant role in determining your loan eligibility.

Higher interest rates result in higher monthly mortgage payments, which may reduce affordability.

It’s essential to consider the current market conditions and how fluctuations in interest rates can affect your loan eligibility.

Budget Planning: Allocating Monthly Funds for Payments

Assessing your current spending habits

Before committing to a mortgage, assessing your current spending habits is essential.

Understanding your expenses allows you to determine how much you can allocate towards mortgage payments without compromising your financial stability.

Look for areas where you can reduce unnecessary costs and reallocate those funds toward your future home.

Creating a budget for mortgage payments

Creating a budget for mortgage payments helps you stay on track with your financial obligations.

Consider all the costs associated with homeownership, including the mortgage payment itself and property taxes, insurance, maintenance, and repairs.

Creating a realistic budget ensures that you can comfortably afford your dream home without any financial strain.

Balancing mortgage payments with other expenses

It’s crucial to balance mortgage payments and other essential expenses.

While owning a home is a significant financial commitment, it shouldn’t leave you unable to meet other financial obligations.

Consider how mortgage payments will impact your ability to save for emergencies, retirement, or other financial goals.

Calculating Affordability for Different Loan Tenures

Understanding the impact of loan duration on monthly payments

The loan duration or tenure directly impacts your monthly mortgage payments.

Shorter loan tenures result in higher monthly payments, but the overall interest paid over the loan term is lower.

Longer loan terms, on the other hand, result in lower monthly payments but may result in paying more interest over the life of the loan.

Consider your financial capability and long-term goals when deciding on the loan tenure.

Assessing your financial capability for short-term loans

Short-term loans often have higher monthly payments, which may require higher financial stability.

Before opting for a short-term loan, consider if you have sufficient income and cash flow to comfortably make the higher monthly payments without causing financial strain.

It’s essential to assess your financial capability and choose a loan tenure that aligns with your income sources.

Long-term loan considerations and affordability

Long-term loans may offer more affordable monthly payments but must be evaluated carefully.

Consider if you foresee any future income or financial commitments changes that may affect your ability to make the monthly payments.

Additionally, consider your long-term financial goals, such as retirement, and how the loan will impact your ability to save for those goals.

Analyzing Property Affordability with the Calculator

Understanding the affordability calculator

An affordability calculator is a powerful tool that helps you evaluate your financial capacity to afford a property.

By inputting your income, expenses, and other financial details, the calculator produces valuable insights regarding the maximum property price you can afford.

Determining your budget with the calculator

Before you start looking for a property, it is crucial to determine your budget.

The affordability calculator considers factors such as your household income, existing debts, and monthly expenses to give you a clear picture of what you can comfortably afford.

It helps you avoid the pitfalls of overspending and ensures you stay within your financial means.

Exploring different property price scenarios

The affordability calculator allows you to explore various property price scenarios, giving you the flexibility to adjust your budget and evaluate the impact on your affordability.

By analyzing different price ranges, you can make informed decisions and choose a property that fits your financial goals.

Evaluating Buyer Stamp Duty and Mortgage Duty

What is buyer stamp duty?

Buyer stamp duty is a tax imposed on the purchase of a property.

It is essential to factor in this cost during the evaluation process.

The affordability calculator considers the applicable buyer stamp duty rates and helps you estimate the amount you must pay.

Calculating buyer stamp duty using the calculator

Using the affordability calculator, you can easily calculate the buyer stamp duty based on the property price.

By inputting the purchase price, the calculator provides an accurate estimate of the stamp duty amount, allowing you to include it in your budget calculations.

Understanding mortgage duty and its impact on affordability

In addition to buyer stamp duty, it is essential to consider mortgage duty when analyzing mortgage costs.

Mortgage duty is a tax imposed on the mortgage loan amount.

By factoring in this cost using the affordability calculator, you can evaluate its impact on your overall affordability and make informed decisions.

Using the Calculator to Factor in Property Taxes

Understanding property taxes

Property taxes are recurring costs that homeowners need to pay.

These taxes are usually based on the property’s value and significantly determine mortgage affordability.

The affordability calculator helps you estimate property taxes, enabling you to consider them in your budgetary calculations.

Estimating property taxes with the calculator

By inputting the property value and other relevant details into the affordability calculator, you can estimate the property taxes you are likely to incur.

This feature gives you a comprehensive understanding of the ongoing expenses of owning a property, allowing you to make more accurate budgetary decisions.

How property taxes affect mortgage affordability

Property taxes directly influence the affordability of a mortgage.

Higher property taxes increase monthly payments and impact your overall financial stability.

By using the affordability calculator to factor in property taxes, you can assess their impact and make informed decisions regarding the affordability of the mortgage.

Estimating Monthly Mortgage Payments and Interest

Calculating monthly mortgage payments

One crucial aspect of mortgage affordability is the monthly mortgage payment.

The affordability calculator helps you calculate these payments based on the loan amount, interest rate, and loan term.

By understanding the monthly payment amount, you can assess whether it fits within your budget.

Finding the correct interest rate with the calculator

The interest rate plays a significant role in determining your mortgage costs.

Using the affordability calculator, you can experiment with different interest rates to find the one that suits your financial goals.

This feature allows you to make informed decisions and secure the best possible interest rate on your mortgage.

Understanding the impact of monthly payments on affordability

The affordability calculator provides insights into the impact of monthly mortgage payments on your overall financial stability.

You can assess their feasibility by analyzing different payment amounts based on your income and expenses.

This information helps you make informed decisions regarding your mortgage affordability.

Balancing Loan Factors: Interest Rates and Loan Terms

Weighing the importance of interest rates in mortgage affordability

Interest rates are a crucial factor to consider when evaluating mortgage affordability.

Using the affordability calculator to compare different interest rates, you can assess their long-term impact on your mortgage costs.

This information empowers you to choose the best interest rate that aligns with your financial goals.

Choosing the right loan term for your affordability goals

The loan term is another critical consideration when assessing mortgage affordability.

Using the affordability calculator, you can explore different loan terms and evaluate their impact on your monthly payments and overall costs.

This information helps you choose the loan term that best fits your affordability goals.

How loan factors affect your overall mortgage costs

Loan factors such as interest rates and loan terms directly impact your mortgage costs.

By understanding the relationship between these factors and using the affordability calculator to compare different scenarios, you can make informed decisions to minimize your mortgage costs and enhance your overall affordability.

Conclusion

In conclusion, an affordability calculator is invaluable for analyzing mortgage costs.

By utilizing this calculator, you can understand your financial capabilities and make informed decisions regarding property affordability.

Consider buyer stamp duty, property taxes, and loan terms to ensure your mortgage aligns with your budgetary goals.

Use the affordability calculator’s features to make wise financial choices and secure the best mortgage.

Frequently Asked Questions

What is a mortgage affordability calculator?

A mortgage affordability calculator is a tool that helps individuals determine how much they can afford to borrow for a home loan based on their income, expenses, and other financial factors.

How does a mortgage affordability calculator work?

A mortgage affordability calculator considers your income, monthly expenses, and other financial obligations to estimate the maximum loan amount you can afford.

It considers factors such as interest rates, loan terms, and your ability to make monthly mortgage payments.

Why should I use a mortgage affordability calculator?

A mortgage affordability calculator can help you understand your financial capabilities and set realistic expectations when buying a home.

It prevents you from taking on a loan that exceeds your financial means and enables you to make informed decisions about your mortgage.

How accurate are mortgage affordability calculators?

Mortgage affordability calculators estimate how much you can afford to borrow based on the information you input.

While they can be a helpful tool, it’s important to remember that they can’t account for every financial nuance or future changes in your financial situation.

What factors affect mortgage affordability?

Several factors can affect mortgage affordability, including income, existing debt levels, credit score, interest rates, loan terms, and other financial obligations.

Can a mortgage affordability calculator help with loan modification?

A mortgage affordability calculator may help determine if a loan modification is viable based on your current financial situation.

However, it’s always recommended to consult with a mortgage professional to explore the details and requirements for loan modification.

What types of mortgages and their features should I consider when assessing affordability?

When evaluating mortgage affordability, it’s essential to consider various types of mortgages, such as fixed-rate mortgages, adjustable-rate mortgages, interest-only mortgages, and government-backed loans.

Each type has its features, benefits, and implications on your overall affordability.

How does investment income impact mortgage approval?

Investment income, such as rental or investment dividends, can be considered when assessing mortgage affordability.

Lenders may consider this income to determine your ability to make mortgage payments.

What is the impact of interest rates on mortgage payments?

Interest rates have a direct impact on mortgage payments.

Your monthly mortgage payments may be more affordable when interest rates are lower.

Conversely, higher interest rates can increase your monthly expenses.

How does a mortgage affordability assessment work?

A mortgage affordability assessment considers various factors, including income, expenses, debt levels, credit score, and other financial obligations, to determine the maximum loan amount you can afford.