The BTO payment timeline is an essential element of the process when purchasing a new HDB flat.

It encompasses various stages, from taking an HDB bank loan to understanding the downpayment structure and assessing affordability.

This article will guide you through each step of the payment timeline, ensuring that you are well-informed before embarking on your home-buying journey.

Key Takeaways

| Key Takeaway | Information |

|---|---|

| Applying for HDB BTO Flat | Check upcoming BTO launches on the HDB website. Choose a preferred location and flat type. Submit an online application during the application period. HDB conducts computer ballots to determine queue position. If successful, receive a letter with the booking date and time slot to select a flat. |

| Eligibility Conditions for HDB BTO Flats | To be eligible: Be at least 21 years old and a Singapore Citizen. Not own any other property locally or overseas. Average gross monthly household income must not exceed the income ceiling set for BTO flats. |

| Checking Eligibility for BTO Flat | Use the HDB InfoWEB portal with SingPass to check eligibility criteria. |

| Income Eligibility Criteria for BTO Flat | Income eligibility varies by flat type and the presence of housing grants. Check the HDB website for specific income requirements for each flat type. |

| Singles Eligibility for BTO Flat | Singles above 35 years old, Singapore Citizens, and within the income ceiling can apply for BTO flats under the Single Singapore Citizen Scheme. |

| Age Restrictions for BTO Flat Applicants | Applicants must be at least 21 years old with no upper age limit. |

| CPF Housing Grant | Financial assistance scheme for first-time homebuyers to offset initial flat purchase cost. |

| Eligibility for CPF Housing Grant | Eligibility depends on factors like citizenship, income level, and flat type. First-time homebuyers meeting income criteria and buying from specific BTO launches are eligible. |

| Amount of CPF Housing Grant | Amount varies based on income and flat type. Check the HDB website for specific grant amounts. |

| Booking a BTO Flat | Receive a letter with the booking date and time slot. Book a flat online through the HDB portal. Select a flat unit, pay the option fee, and choose a payment method. |

| Considerations Before Booking a BTO Flat |

Assess financial capability to afford the purchase price. |

| After Booking a BTO Flat | Pay a downpayment (usually 10% of the purchase price) within the stipulated timeline. Wait for key collection after BTO project completion. |

| BTO Payment Timeline | Consists of the booking stage, interim payment stage, and key collection stage. |

| Payment Modes for BTO Flat | Payment modes include using CPF savings and taking out a bank loan. |

| Downpayment Timeline for BTO Flat | Downpayment (10% of purchase price) is usually due within 4 months from the booking date. |

| HDB Bank Loan Process | It involves applying for a loan from selected banks to finance flat purchases. |

| Determining Loan Eligibility | Eligibility depends on factors like income, age, and citizenship status. Applicants must meet specific HDB criteria. |

| Calculating Monthly Loan Instalments | Calculate monthly installments using loan amount, interest rate, and loan tenure. |

| Overview of HDB Cool Measures | Regulations to manage demand and ensure a sustainable housing market. Includes restrictions on loan quantum, additional stamp duties, and eligibility criteria for certain flats. |

| Evaluating Impact of Cool Measures | Cool measures can affect loan eligibility, amount, and overall flat affordability. Seek advice from professionals to navigate measures successfully. |

| Alternatives Amidst Cool Measures | Explore financing options beyond HDB bank loans and consider different flat types or locations that may be more affordable. |

| Understanding Purchase Price of HDB Flat | Purchase price includes flat cost, stamp duties, legal fees, and optional features’ premiums. |

| Assessing Affordability for BTO Flat | Evaluate combined income, financial commitments, and future expenses to ensure loan instalments fit the budget. |

| Setting a Realistic Budget | Create a detailed budget for upfront and future expenses to avoid financial strain. Use online resources and tools like the Stamp Duty Calculator for cost estimation. |

| Downpayment at Signing | Downpayment amount varies by flat type. Consider using CPF savings or applying for a bank loan to finance the downpayment. |

| Types of HDB Flats Available for BTO | Various types like 2-room Flexi, 3-room, 4-room, 5-room, and 3Gen flats cater to different household sizes and budgets. |

| Eligibility Criteria for BTO Flat | Requirements include citizenship status, income ceiling, and whether first-time or second-time applicant. |

| First-Timer and Second-Timer Applicants | First-timer applicants haven’t owned an HDB flat or received housing subsidies before. Second-timer applicants have previously owned an HDB flat or received subsidies. |

| Staggered Downpayment Scheme | Allows spreading out payments over time for easier cash flow management. |

| Pros and Cons of Staggered Downpayment | Offers flexibility in payments but extends the overall timeline for property purchase. |

| Applying for Staggered Downpayment | Indicate interest during flat booking appointments. Pay the first downpayment within a month after the sales exercise. Make subsequent downpayments in regular installments until full payment is completed. |

| Applying for HDB SBF Flat | Sale of Balance Flats is resold by current owners. Availability is limited and offered alongside BTO sales exercises. |

| Key Differences: BTO Flats vs. SBF Flats | BTO flats are new and sold directly by HDB, while SBF flats are older and resold by owners. Availability and eligibility criteria differ. |

| Considerations for HDB SBF Flat Purchase | Evaluate the unit condition and renovation costs. Engage property agent for assistance. |

| Stamp Duties and Fees | Taxes and charges levied on documents involved in flat purchase. Includes Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD). |

| Types of Stamp Duties and Fees | BSD is calculated based on the purchase price. ABSD is imposed on certain categories of buyers. |

| Calculating Stamp Duties and Fees | Use IRAS stamp duty calculator to determine the amount payable. Factor in these costs when budgeting for flat purchases. |

| HDB BTO Flat Collection | Steps include paperwork completion, balance payment, engaging a solicitor, and scheduling key collection appointments. |

| Documents Required for BTO Flat Collection | Bring a letter of offer, NRIC, proof of payment, and other requested documents to the collection appointment. |

| Guidelines for Collecting HDB BTO Flat | Follow procedures, make outstanding payments, and apply for utilities and home insurance. Allocate ample time for the appointment. |

| Balloting Process | Submit an application during BTO sales exercises. Balloting randomly allocates flats to eligible applicants. Results determine successful booking. |

Understanding the HDB BTO Flat Application Process

What is the process of applying for an HDB BTO flat?

Applying for an HDB BTO flat involves several steps.

First, you need to check for upcoming BTO launches on the HDB website and choose the preferred location and flat type.

Then, you submit your online application during the application period.

Following this, HDB will conduct a computer ballot to determine the queue position.

If successful, you’ll receive a letter with a booking date and time slot to select your flat.

What are the eligibility conditions for HDB BTO flats?

To be eligible for a BTO flat, you must meet certain conditions.

You need to be at least 21 years old and a Singapore Citizen.

Additionally, you should not own any other property locally or overseas, and your average gross monthly household income must not exceed the income ceiling set for BTO flats.

How can I check my eligibility to apply for a BTO flat?

You can check your eligibility to apply for a BTO flat through the HDB’s HDB InfoWEB portal.

Simply log in with your SingPass and navigate to the “Eligibility” section to check if you meet the required criteria.

Eligibility Conditions for HDB BTO Flats: Are You Eligible to Apply?

What are the income eligibility criteria for applying

for a BTO flat?

The income eligibility criteria for applying for a BTO flat vary depending on the flat type and the presence of any housing grants.

For example, for a 2-room Flexi flat, the monthly household income ceiling is $14,000 for families and $21,000 for extended families.

It’s crucial to refer to the HDB website for the specific income requirements for each flat type.

Can singles apply for a BTO flat?

Yes, singles above 35 years old are eligible to apply for BTO flats under the Single Singapore Citizen Scheme.

They must be Singapore Citizens and fall within the income ceiling to be eligible.

Are there any age restrictions for BTO flat

applicants?

As mentioned earlier, applicants must be at least 21 years old to be eligible.

There is no upper age limit for applying for a BTO flat, meaning anyone above the age of 21 can submit an application.

CPF Housing Grant: Assistance for First-Time Homebuyers

What is the CPF Housing Grant?

The CPF Housing Grant is a financial assistance scheme provided by the government to support first-time homebuyers.

The grant helps to offset the initial cost of purchasing a flat, making homeownership more affordable and accessible.

Who is eligible for the CPF Housing Grant?

The eligibility for the CPF Housing Grant depends on factors such as citizenship, income level, and flat type.

Usually, first-time homebuyers who meet the income criteria and are purchasing a flat from specific BTO launches are eligible to apply for the grant.

How much CPF Housing Grant can I receive?

The amount of CPF Housing Grant you can receive varies based on your income and the flat type you are purchasing.

For example, eligible first-timers buying a 2-room Flexi flat can receive up to $80,000 in grants, while those purchasing a 4-room flat can receive up to $40,000.

It’s important to review the available grants on the HDB website to determine the specific amount you are eligible for.

Booking a BTO Flat: Step-By-Step Guide to Securing Your Dream Home

How do I book a BTO flat?

Once you have received the letter with the booking date and time slot, you can book your BTO flat online through the HDB portal.

During the booking process, you’ll need to select the flat unit, pay the option fee, and indicate your preferred payment method.

What are the important things to consider before booking a

BTO flat?

Before booking a BTO flat, there are several factors you should consider.

Firstly, you should assess your financial capability and ensure that you’re able to afford the purchase price.

Additionally, evaluate the location and amenities of the selected BTO project to ensure it aligns with your lifestyle and preferences.

Lastly, take into account the estimated waiting time for the completion of the BTO project.

What happens after I have successfully booked a BTO flat?

After successfully booking a BTO flat, you’ll need to pay the downpayment within the stipulated timeline.

The downpayment is usually 10% of the purchase price and can be paid using your CPF savings or through a bank loan.

Once the downpayment is settled, you’ll wait for the key collection when the construction of the BTO project is completed.

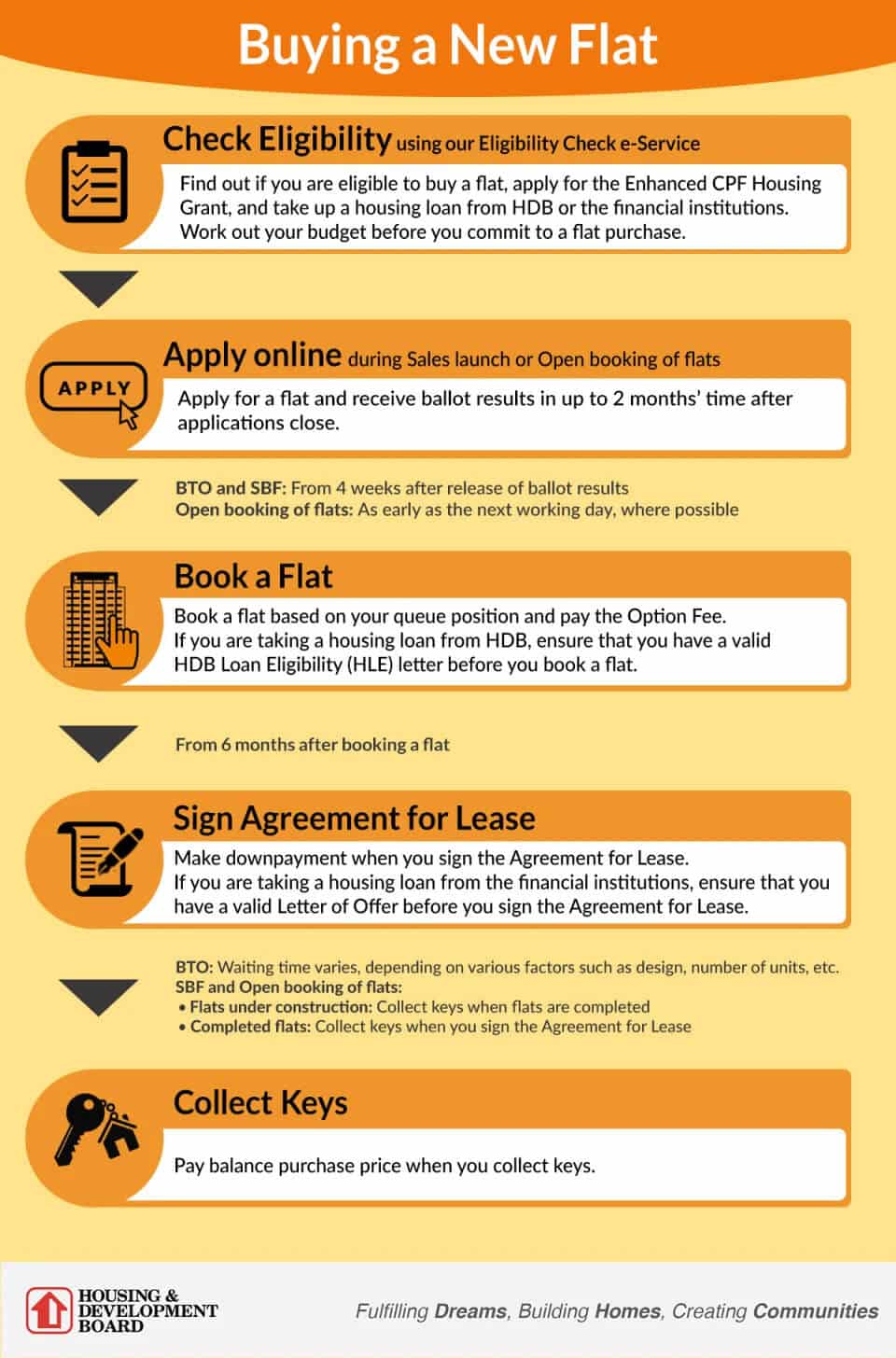

HDB BTO Payment Timeline: Key Stages and Payment Modes

What are the key stages in the BTO payment timeline?

The BTO payment timeline consists of several key stages.

The first stage is the booking stage, where you pay the downpayment and exercise your option to purchase the flat.

Next, there is the interim payment stage, where you’ll pay the balance payment incrementally as the construction progresses.

Finally, the last stage is the key collection stage, where you’ll complete the payment and collect the keys to your new BTO flat.

What are the different payment modes for a BTO flat?

There are two main payment modes for a BTO flat – using your CPF savings and taking out a bank loan.

The downpayment can be made using your CPF savings, while the remaining balance can be paid using a combination of CPF savings and a bank loan.

It’s important to review your financial situation and assess the most suitable payment mode for your needs.

When do I need to make the downpayment for my BTO flat?

The downpayment for your BTO flat usually needs to be paid within 4 months from the date of booking.

This 10% payment is a crucial step that secures your BTO flat and initiates the payment process.

As you can see, the BTO payment timeline is a crucial aspect of the homebuying process.

Understanding the key stages and payment modes can help you plan your finances and make an informed decision.

Whether you’re a first-time homebuyer or looking to upgrade your flat, the BTO payment timeline plays a significant role in your homeownership journey.

Make sure to carefully review the eligibility conditions, explore housing grants, and consult professionals to navigate through the process seamlessly.

Taking an HDB Bank Loan: Financing Options and Loan Eligibility

Understanding the HDB Bank Loan Process

When financing your HDB flat, one of the options available is to obtain an HDB bank loan.

The HDB bank loan process involves applying for a loan from selected banks to finance your flat purchase.

It is important to familiarize yourself with the loan application process, including the necessary documents and eligibility criteria.

Determining Your Loan Eligibility

Before applying for an HDB bank loan, it is crucial to determine your loan eligibility.

Eligibility is dependent on factors such as your income, age, and citizenship status.

The HDB sets specific criteria that applicants must meet to be eligible for a loan.

By understanding the eligibility requirements, you can assess your chances of obtaining a loan and plan your home purchase accordingly.

Calculating Your Monthly Loan Instalments

Calculating your monthly loan instalments is essential for proper financial planning.

By using the loan amount, interest rate, and loan tenure, you can estimate the amount you need to repay each month.

This calculation allows you to budget your expenses and determine if the loan instalments are within your financial means.

Cool Measures: How Do They Affect the HDB BTO Buying Process?

Overview of HDB Cool Measures

HDB cool measures are regulations implemented by the government to manage demand and ensure a sustainable housing market.

They aim to strike a balance between providing affordable housing options and preventing speculative activity.

These measures can include restrictions on loan quantum, additional stamp duties, and eligibility criteria for certain types of flats.

Familiarizing yourself with these measures is crucial when planning your BTO purchase.

Evaluating the Impact of Cool Measures on BTO Applicants

Cool measures can have a significant impact on BTO applicants.

They may affect an applicant’s loan eligibility, loan amount, and overall affordability of the flat.

It is important to assess how these measures may impact your specific situation and plan accordingly.

Consulting with a mortgage broker or seeking legal counsel can provide you with valuable insights and guidance in navigating these measures.

Alternatives to Consider Amidst Cool Measures

While cool measures may impose certain restrictions, there are alternatives to consider when purchasing an HDB BTO flat.

For example, you can explore financing options other than HDB bank loans, such as obtaining a housing loan from a financial institution.

Additionally, you can consider different flat types or locations that may be more affordable or have different eligibility criteria.

By exploring these alternatives, you can increase your chances of securing a suitable flat.

Understanding the Purchase Price: Assessing Affordability and Budgeting

Breaking Down the Purchase Price of an HDB BTO Flat

The purchase price of an HDB BTO flat consists of various components.

It includes the price of the flat itself, as well as additional costs such as stamp duties, legal fees, and premiums for optional features.

Understanding the breakdown of the purchase price allows you to assess the affordability of the flat and plan your budget accordingly.

Assessing Your Affordability for a BTO Flat

Assessing your affordability for a BTO flat involves considering your combined income, existing financial commitments, and future expenses.

It is essential to evaluate whether the monthly loan instalments, along with other housing-related costs, are manageable within your budget.

By conducting a thorough assessment, you can avoid financial strains and ensure a smooth payment process.

Setting a Realistic Budget for Your BTO Purchase

Setting a realistic budget for your BTO purchase is crucial to avoid any financial burdens.

Consider not only the upfront costs but also future expenses such as renovations and furnishings.

Creating a detailed budget will help you allocate funds accordingly and prevent overspending.

There are various online resources and tools, such as the Stamp Duty Calculator, that can assist you in estimating costs and creating a comprehensive budget.

Downpayment at Signing: What You Need to Pay Upfront

Understanding the Downpayment Structure for a BTO Flat

When signing the lease agreement for your BTO flat, you are required to make a downpayment.

The downpayment amount depends on the type of flat you are purchasing.

It is crucial to understand the downpayment structure and ensure that you have the necessary funds available at the time of booking.

Calculating the Downpayment Amount Based on Flat Type

The downpayment amount varies depending on the flat type chosen.

For example, a 4-room BTO flat requires a higher downpayment compared to other flat types.

It is important to calculate the specific downpayment amount based on your chosen flat to ensure you have the correct financial resources at hand.

Options for Financing Your Downpayment

If you require assistance in financing your downpayment, there are various options available.

One option is to use your CPF Ordinary Account savings, which can be used for housing-related expenses.

You can also consider applying for a bank loan or exploring alternative financing solutions.

It is essential to carefully evaluate these options and choose the one that best suits your financial situation.

HDB Flat Eligibility: Types of Flats and Eligible Applicants

Types of HDB Flats Available for BTO

There are different types of HDB flats available for BTO, catering to various household sizes and budgets.

These include 2-room Flexi, 3-room, 4-room, 5-room, and 3Gen flats.

Understanding the different flat types and their specifications will help you determine the most suitable option for your needs.

Eligibility Criteria for Applying for a BTO Flat

Applying for a BTO flat requires meeting specific eligibility criteria set by the HDB.

These criteria include citizenship status, income ceiling, and whether you are a first-timer or second-timer applicant.

Familiarize yourself with these criteria to ensure that you meet the necessary requirements before submitting your application.

Understanding First-Timer and Second-Timer Applicants

In the context of HDB flat eligibility, first-timer applicants refer to individuals or households who have not previously owned an HDB flat or received any housing subsidies.

Second-timer applicants, on the other hand, are those who have previously owned an HDB flat or received housing subsidies.

Understanding the distinction between these two categories is essential when assessing your eligibility for a BTO flat.

The Staggered Downpayment Scheme: Managing Payments Over Time

When it comes to purchasing a new home, managing payments can be a daunting task for prospective homebuyers.

However, the Housing and Development Board (HDB) in Singapore offers a solution through the Staggered Downpayment Scheme.

This scheme allows homebuyers to spread out their payments over time, making it easier to manage their finances.

Understanding the Staggered Downpayment Scheme

The Staggered Downpayment Scheme is a payment option provided by HDB for new flat buyers.

Under this scheme, instead of the traditional method of paying a lump sum downpayment, buyers can make their payment in smaller installments.

The payment amount is staggered over a period of time, typically spread out over several months.

Pros and Cons of the Staggered Downpayment Scheme

The Staggered Downpayment Scheme offers several advantages to homebuyers.

Firstly, it allows buyers to better manage their cash flow by spreading out their payments over a period of time.

This can be particularly helpful for those who may have other financial commitments or outstanding loans.

However, there are also some considerations to keep in mind.

While the Staggered Downpayment Scheme provides more flexibility in terms of payment, it also means that buyers will have to make multiple payments over a longer period of time.

This can extend the overall timeline for purchasing a property.

How to Apply for the Staggered Downpayment Scheme

In order to apply for the Staggered Downpayment Scheme, homebuyers must first submit their flat application through the HDB sales launch exercises.

Once the application is successful, buyers can indicate their interest in the scheme during the flat booking appointment.

The flat buyer will then be required to pay the first downpayment within a specified timeframe, usually within a month after the sales exercise.

The subsequent downpayments will be made in regular installments until the full payment is completed.

Applying for an HDB SBF Flat: Key Differences and Considerations

What is an HDB SBF Flat?

An HDB SBF flat refers to a flat that is being resold by the current owner.

These flats are usually older and may have been previously occupied.

The availability of SBF flats is limited, and they are typically offered in conjunction with BTO sales exercises.

Unlike BTO flats, which are sold at a subsidized price to first-time buyers, SBF flats are generally open to all eligible buyers, including those who own private properties or have previously enjoyed housing subsidies.

Key Differences Between BTO Flats and SBF Flats

There are several key differences between BTO flats and SBF flats.

Firstly, BTO flats are brand new and are sold directly by HDB, whereas SBF flats are resold by the current owners.

This means that SBF flats may have been occupied before and could require renovation.

Another difference is the availability.

BTO flats are more readily available as they are built specifically for each sales exercise, while SBF flats are limited in numbers and depend on the availability of units put up for sale by existing owners.

Important Considerations When Applying for an HDB SBF Flat

When considering purchasing an SBF flat, it is important to carefully evaluate the condition of the unit and consider the potential renovation costs.

Unlike BTO flats, SBF flats may require more extensive renovation, depending on the age and condition of the unit.

It is also advisable to engage the services of a property agent who specializes in resale flats in order to navigate the complex transaction process and ensure a smooth and successful purchase.

Stamp Duties and Fees: Additional Costs Involved in Purchasing an HDB Flat

When buying an HDB flat, it is important to be aware of the additional costs involved besides the purchase price.

One of these costs is the stamp duties and fees, which are payable to the government.

Understanding Stamp Duties and Fees

Stamp duties and fees refer to the taxes and charges levied on the documents involved in the purchase of an HDB flat.

These fees are imposed by the Singapore government and are required to be paid by the buyer.

The purpose of stamp duties and fees is to ensure that all property transactions are properly recorded and documented, and to generate revenue for the government.

Types of Stamp Duties and Fees

There are several types of stamp duties and fees applicable to the purchase of an HDB flat.

The two main types are the Buyer’s Stamp Duty (BSD) and the Additional Buyer’s Stamp Duty (ABSD).

The BSD is calculated based on the purchase price of the flat.

The ABSD, on the other hand, is an additional stamp duty imposed on certain categories of buyers, such as foreigners and individuals who already own residential properties in Singapore.

Calculating Stamp Duties and Fees

The amount of stamp duties and fees payable depends on the purchase price of the flat and the buyer’s profile.

The Inland Revenue Authority of Singapore (IRAS) provides a stamp duty calculator on their website, which buyers can use to determine the exact amount payable.

It is important to factor in these additional costs when budgeting for the purchase of an HDB flat in order to avoid any unexpected financial burdens.

HDB BTO Flat Collection: Key Steps and Important Documents

Once the balloting process is successfully completed and the buyer has been notified of the successful booking, the next step is the collection of the HDB BTO flat.

This process involves several key steps and requires the submission of important documents.

Steps for Collecting Your HDB BTO Flat

After receiving the letter of offer, the buyer is required to complete the necessary paperwork and make the payment of the balance of the purchase price.

The buyer will also need to engage a solicitor or a conveyancing firm to handle the legal aspects of the property transfer.

Once all the necessary documents and payments have been submitted, the buyer can schedule a date for the key collection.

During this appointment, the buyer will officially take possession of the flat.

Documents Required for HDB BTO Flat Collection

There are several important documents that the buyer must bring during the HDB BTO flat collection appointment.

These documents include the letter of offer, the buyer’s NRIC, proof of payment of the balance of the purchase price, and any other relevant supporting documents requested by HDB.

It is important to ensure that all the required documents are prepared in advance to avoid any delays or complications during the collection process.

Guidelines for Collecting Your HDB BTO Flat

During the collection appointment, the buyer will be guided through the necessary procedures and given instructions on the next steps, such as applying for utilities and home insurance.

The buyer will also be briefed on any outstanding payments, such as renovation costs, that need to be settled.

It is advisable for buyers to allocate ample time for the collection appointment to ensure a smooth and efficient process.

Balloting Process: From Application to Balloting to Successful Booking

The balloting process is a crucial step in securing a BTO flat in Singapore.

Understanding the process and following some tips can help increase your chances of successful booking.

Understanding the Balloting Process

The balloting process begins with the submission of the BTO application.

Prospective buyers can apply for a BTO flat during the sales exercises conducted by HDB.

The number of flat applications received during each exercise determines the demand and competition for the available units.

After the application period ends, the balloting process takes place, where flats are randomly allocated to eligible applicants.

The results of the balloting will determine whether the applicant has successfully secured a flat.

Conclusion

In conclusion, the process of applying for an HDB BTO flat involves several steps, starting with checking for upcoming BTO launches on the HDB website and submitting your online application during the specified period.

Eligibility is a critical factor, and applicants must meet certain conditions, such as being a Singapore Citizen, meeting age requirements, and adhering to income ceilings.

To check your eligibility, you can use the HDB InfoWEB portal and log in with your SingPass.

Additionally, understanding the CPF Housing Grant can be beneficial as it provides financial assistance to first-time homebuyers, making homeownership more accessible.

After successfully booking a BTO flat, you’ll need to pay the downpayment within a specific timeframe, initiating the payment process.

The BTO payment timeline consists of several key stages, including booking, interim payments, and key collection.

Cool measures play a vital role in managing housing demand and the housing market’s sustainability.

They can impact applicants’ eligibility and the overall affordability of BTO flats, so exploring alternatives and assessing their effects is essential.

Moreover, it’s crucial to understand the types of HDB flats available, such as BTO flats and SBF flats, and their differences before making an informed decision.

Stamp duties and fees are additional costs involved in the purchase of an HDB flat, and calculating them is necessary for proper budgeting.

Finally, once the balloting process is successful, collecting your HDB BTO flat involves completing the necessary paperwork, engaging a solicitor, and submitting required documents.

Being well-prepared during this process will ensure a smooth and efficient collection appointment.

We hope this comprehensive guide has provided you with valuable insights into the HDB BTO flat application process and the essential considerations.

If you’re interested in exploring other aspects of the homebuying journey or learning more about homeownership in Singapore, we encourage you to check out our other blog articles.

Frequently Asked Questions

What is the payment timeline for buying a HDB BTO flat?

The payment timeline for buying a HDB BTO flat can vary depending on several factors.

Let’s take a look at the general timeline to help you figure out when you need to make certain payments.

When can I start applying for a new flat?

You can start applying for a new flat as soon as the application period opens.

For BTO flats, the application period usually starts in May and August each year.

How long will it take for the BTO flat to be ready?

The estimated construction time for BTO flats can vary, but it generally takes around 3 to 4 years from the time you apply for the flat to the time it is ready for you to move in.

What do I need to do to be eligible for an HDB BTO flat?

To be eligible for an HDB BTO flat, you need to meet certain criteria set by HDB.

This includes being a Singapore citizen, at least 21 years old, and fulfilling the various eligibility schemes and requirements.

Can I purchase a BTO flat with an HDB loan?

Yes, you can purchase a BTO flat with an HDB housing loan.

The HDB loan will cover a portion of the flat’s purchase price, and you will need to make a downpayment for the remaining amount.

How much is the downpayment for a BTO flat?

The downpayment for a BTO flat is typically 25% of the purchase price.

This means that if the flat’s purchase price is $400,000, you will need to make a downpayment of $100,000.

What is the LTV ratio for buying a new HDB flat?

The Loan to Value (LTV) ratio for buying a new HDB flat is 90%.

This means that the maximum amount you can borrow for the flat is 90% of its purchase price.

When do I need to make the downpayment for the BTO flat?

The downpayment for the BTO flat is usually required to be made within 4 months from the date of booking the flat.

However, you should refer to the specific payment schedule provided by HDB for the exact timeline.

What is the payment timeline if I take out a bank loan for the BTO flat?

If you choose to take out a bank loan to finance your BTO flat, the payment timeline may differ from the HDB loan timeline.

It is advisable to check with the bank for the specific payment schedule and requirements.

What happens if I miss a payment for the BTO flat?

If you miss a payment for the BTO flat, there may be penalties and consequences.

It is important to fulfill your payment obligations on time to avoid any legal or financial issues.