What is the Enhanced Retirement Sum (ERS)?

Definition of the ERS

The Enhanced Retirement Sum (ERS) is a concept coined by the Central Provident Fund (CPF) Board in Singapore.

It refers to the amount of money individuals are encouraged to set aside in their CPF Retirement Account (RA) to ensure a comfortable retirement.

The ERS is one of three retirement sums defined by the CPF Board, alongside the Full Retirement Sum (FRS) and the Basic Retirement Sum (BRS).

These sums are designed to provide individuals with a steady stream of income in their golden years.

How is the ERS calculated?

The ERS is determined based on the individual’s age and the prevailing CPF retirement sums.

The CPF retirement sums are adjusted annually and set higher every year to account for inflation and increased life expectancy.

Currently, the ERS is three times the Basic Retirement Sum (BRS), while the Full Retirement Sum (FRS) is two times the BRS.

To reach the ERS, individuals can contribute to their CPF Retirement Account through regular monthly CPF contributions, voluntary contributions, or transferring funds from their Ordinary Account or Special Account.

CPF Withdrawal, which starts at age 55, can be used as a source to achieve the ERS as well.

By meeting the ERS, individuals can enjoy monthly payouts from their CPF Retirement Account during retirement, allowing them to cover their basic living expenses and maintain a comfortable retirement lifestyle.

Benefits of meeting the ERS

Meeting the ERS has several benefits for individuals planning their retirement.

By achieving the ERS, individuals are eligible for a higher monthly payout from their CPF Retirement Account.

This additional income can help cover basic living expenses and provide a source of steady retirement income.

With monthly payouts, individuals can better plan for their retirement lifestyle, ensuring they have sufficient funds to support their desired retirement goals.

Whether it’s traveling, pursuing hobbies, or spending time with family, meeting the ERS provides individuals with a source of income to fulfill their dream retirement.

https://www.youtube.com/watch?v=v-tXEpv5NQA

In addition, individuals who meet the ERS are eligible for the CPF LIFE Bonus and Deferment Bonus. According to CPF at 55, withdraw from your CPF account increase of about 3 retirement sums.

These bonuses provide additional monthly payouts and incentives for individuals to set aside more funds in their CPF Retirement Account, further enhancing financial security during retirement.

Key Takeaways

- Definition of ERS: The ERS is an amount individuals are encouraged to save in their CPF Retirement Account for a comfortable retirement. It’s one of three retirement sums defined by the CPF Board.

- Calculation of ERS: ERS is determined based on age and CPF retirement sums. It’s currently three times the Basic Retirement Sum (BRS).

- Benefits of Meeting ERS: Meeting ERS means higher monthly payouts, which can cover living expenses and fulfill retirement dreams. CPF LIFE Bonus and Deferment Bonus are additional benefits.

- Eligibility for ERS: Eligibility requires being at least 55, having a CPF Retirement Account, and opting for CPF LIFE scheme.

- Strategies for Meeting ERS: Strategies include early retirement planning, higher CPF contributions, and CPF Sum Topping-Up Scheme.

- Tips for Meeting ERS: Tips include increasing monthly CPF contributions, visualizing retirement goals, and seeking professional financial advice.

- Current ERS Rates: As of 2023, ERS rates range from $324,000 to $391,000, depending on birth year, and remain in effect until 2027.

- Trends in ERS Rates: ERS rates are periodically reviewed and adjusted to keep pace with living standards, ensuring a secure retirement.

- Exceeding ERS: Exceeding ERS offers benefits, including flexibility in withdrawing excess CPF savings.

- Alternatives to ERS: Consider alternatives like CPF Life, partial withdrawal, and investing CPF savings to tailor your retirement plan.

How to Meet the Enhanced Retirement Sum

Eligibility requirements for meeting the ERS

Meeting the Enhanced Retirement Sum (ERS) in Singapore requires meeting specific eligibility requirements.

These include:

- Age 55: You must be at least 55 years old to be eligible for the ERS.

- Turning 55: The ERS can be met anytime between the ages of 55 and 65.

- CPF Basic Retirement Sum: The ERS amount is determined by adding the CPF Basic Retirement Sum with additional amounts.

- CPF Retirement Account: You need to have a CPF Retirement Account to meet the ERS.

- CPF LIFE scheme: Opting for the CPF LIFE scheme ensures a monthly income for life after completing the ERS.

- CPF Beginner’s Retirement Sum: If you have yet to meet the Basic Retirement Sum, your ERS will be set at the Basic Retirement Sum.

Strategies for meeting the ERS

To meet the ERS and secure a comfortable retirement, here are some strategies to consider:

- Plan for retirement: Start planning for retirement early to ensure you have enough savings to meet the ERS.

- Higher monthly payouts: Contribute more to your CPF account to enjoy higher monthly payouts in retirement.

- CPF Sum Topping-Up Scheme: Consider topping up your CPF account to meet the ERS and enjoy higher income during retirement.

- Base rate and excess savings: Utilize any extra savings to meet the ERS and receive additional interest under the base rate.

- Secure your financial future: Invest wisely and explore other income-generating options to achieve financial security in retirement.

Tips for increasing your chances of meeting the ERS

To increase your chances of meeting the ERS goal, here are some tips:

- Increase monthly CPF contributions: By increasing your monthly CPF contributions, you can build up your retirement savings faster.

- Plan for retirement money: Ensure you have a clear understanding of your retirement needs and set aside enough money to meet them.

- Visualize your dream retirement: Create a vision of your ideal retirement and calculate the estimated costs to motivate savings.

- Remember that the ERS is set to provide a stream of income in your future: Aim to meet the ERS to enjoy larger monthly payouts during retirement.

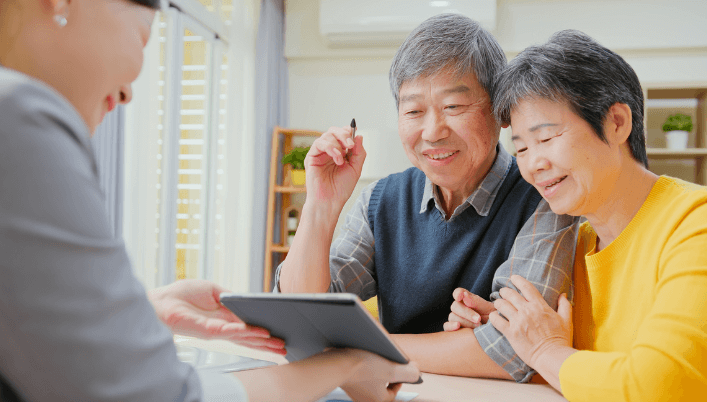

- Seek professional financial planning advice: Consult with a financial planner to create a tailored plan to meet the ERS and secure your financial future.

https://www.youtube.com/watch?v=ISBKSnjaw0k

Enhanced Retirement Sum in Singapore: Full Retirement Sum

Current ERS rates in Singapore

The Enhanced Retirement Sum (ERS) in Singapore is the amount that individuals are encouraged to set aside in their Central Provident Fund (CPF) account to support their retirement needs.

As of 2023, the ERS rates range from $324,000 to $391,000, depending on the individual’s birth year.

These rates will remain in effect until 2027.

Upon reaching the eligibility age of 65, CPF members who meet the ERS requirement will receive monthly payouts from CPF LIFE, which stands for the CPF Lifelong Income for the Elderly.

The amount of payouts depends on various factors, such as the actual CPF LIFE payout eligibility age and the CPF interest rates.

To help individuals plan for their retirement, the CPF LIFE Basic Plan and the CPF LIFE Estimator tool are available.

The Basic Plan provides a steady stream of income for life, while the Estimator tool allows individuals to estimate their CPF LIFE payouts based on their chosen ERS and preferred payout start age.

Additionally, the CPF account offers attractive interest rates.

The first $60,000 of a member’s combined CPF balances earns an extra 1% interest per annum, while the next $30,000 earns an additional 1.

5% per annum.

These additional interest rates aim to enhance retirement savings.

Trends in ERS rates in Singapore

The ERS rates in Singapore are periodically reviewed and adjusted to ensure that they keep pace with rising living standards.

The retirement sums applicable to different birth cohorts are set based on factors such as life expectancy and inflation.

With the ERS, Singaporeans can aim for a secure and comfortable retirement.

The monthly payouts received through CPF LIFE help to supplement their retirement income and cover daily expenses.

Exceeding the ERS offers additional benefits.

Members who have set aside amounts beyond the ERS can enjoy the flexibility of withdrawing their excess CPF savings or transferring them to a Retirement Account (RA) for even more significant payouts.

Over the years, CPF LIFE has seen improvements in its standard plan, providing better security and flexibility for retirees.

The rates for workers aged 55 and above have also been adjusted to ensure fair and adequate support.

Members can choose from different CPF LIFE plans, which include a range of options, such as investments in unit trusts to increase future income potentially.

By adopting the ERS and CPF LIFE, individuals in Singapore can enjoy a reliable stream of income during retirement and have peace of mind knowing that their savings will provide for their needs in their golden years.

Planning for Retirement with the Enhanced Retirement Sum

Setting retirement goals

Setting clear retirement goals is essential to ensure a comfortable future.

The Enhanced Retirement Sum (ERS) in Singapore is designed to provide CPF members with a higher monthly payout during retirement.

By understanding the different retirement sums and leveraging the CPF system, individuals can build a strong foundation for their retirement savings.

The Full Retirement Sum (FRS) is the basic sum required to enjoy the CPF LIFE scheme’s monthly payouts.

The ERS is set at two times the FRS and offers a higher monthly payout.

By aiming to achieve the ERS, individuals can increase their retirement income and have a more fulfilling retirement.

Creating a retirement budget

Once retirement goals are set, it is crucial to create a realistic retirement budget.

Consider your anticipated living expenses, including healthcare, housing, and daily needs.

Use a retirement calculator to estimate the costs you will incur by the age of 65.

The CPF Basic Retirement Sum (BRS) is a guideline for the basic retirement income needed to meet basic needs.

It covers essential expenses and ensures a comfortable retirement.

However, it is important to note that the cost of living increases over time.

Therefore, it is wise to plan for inflation and consider how the cost of living increases will impact your retirement expenses.

Choosing the right CPF withdrawal scheme

CPF members can choose between the CPF LIFE Standard Plan or the CPF LIFE Basic Plan when they turn 55.

The CPF LIFE Standard Plan offers higher monthly payouts, while the Basic Plan provides lower but more stable monthly payouts.

To make an informed decision, individuals can use the CPF LIFE Estimator tool to estimate their monthly payouts based on different scenarios.

Additionally, the CPF LIFE Bonus and Deferment Bonus provide incentives for deferring the start of CPF LIFE payouts.

By understanding these withdrawal schemes and utilizing the CPF system effectively, individuals can maximize their retirement income and enjoy a worry-free retirement.

In conclusion, planning for retirement with the Enhanced Retirement Sum in Singapore offers individuals a higher monthly payout and a more comfortable retirement.

By setting clear retirement goals, creating a realistic retirement budget, and choosing the suitable CPF withdrawal scheme, individuals can ensure a financially secure and fulfilling retirement.

Alternatives to the Enhanced Retirement Sum: Know about the CPF Retirement Sum

If you’re a resident of Singapore nearing retirement age, you may have heard of the Enhanced Retirement Sum (ERS).

However, you may need to be made aware that there are several alternatives to consider when planning for your retirement.

These alternatives offer different options to help you secure a comfortable retirement while still meeting your financial goals.

CPF Life

One popular alternative is the CPF Life scheme, which provides a lifelong monthly payout based on your CPF savings and the plan you choose.

With CPF Life, you have the option to select from various projects, such as the Basic Plan 2022, Standard Plan, or Escalating Plan, depending on your individual needs and preferences.

To help you determine the best plan for you, you can use the CPF Life Estimator, a tool that calculates the payouts based on different scenarios.

Partial withdrawal of CPF savings

Another option is to consider a partial withdrawal of your CPF savings.

This allows you to withdraw a portion of your CPF savings while leaving the remaining funds to continue growing and providing for your retirement.

The Retirement Sum Topping-Up Scheme is one way to enhance your CPF savings by transferring excess funds from your CPF account to your Retirement Account.

You can also choose to receive cash via PayNow to cover your living expenses.

Investing your CPF savings

If you have a good understanding of investing, consider exploring the option of investing your CPF savings.

The CPF Funds Investment Scheme (CPFIS) allows you to invest in various investment options, such as stocks, bonds, and unit trusts.

By investing your CPF savings, you have the potential to earn higher returns and grow your retirement nest egg.

You can explore the options available on the Fund Mall and make fund transfers accordingly.

These are just a few alternatives to the Enhanced Retirement Sum that are worth considering when planning for your retirement in Singapore.

Each option offers its advantages and considerations, so it’s essential to assess your financial goals and risk tolerance before making a decision.

By exploring these alternatives and understanding the available options, you can work towards building a secure and comfortable retirement for yourself.

Conclusion

After exploring the various aspects of the Enhanced Retirement Sum in Singapore, it is clear that this policy will significantly affect retirement planning for individuals.

The sum at age 55 plays a crucial role in determining the amount of CPF savings available for retirement.

Understanding the CPF retirement scheme and the three retirement sums – Full Retirement Sum (FRS), Basic Retirement Sum (BRS), and Enhanced Retirement Sum (ERS) – is essential for every individual.

Hitting the FRS ensures a higher monthly payout through the CPF Life scheme, providing a more comfortable retirement.

However, aiming for the ERS offers even more security and a higher monthly income.

Withdrawing from the CPF account becomes possible for those who have hit the FRS or ERS.

This allows individuals to enjoy a portion of their savings during retirement while still having a regular monthly income through CPF Life payouts.

It is important to note that the CPF Board adjusts the retirement sums periodically based on the prevailing CPF Life premium rates and life expectancy.

This ensures that individuals can maintain a sustainable retirement income and cope with potential increases in healthcare costs.

By planning and setting aside higher CPF savings, individuals can strive for a more secure retirement.

Saving up to three times the BRS not only provides a higher monthly CPF Life payout but also covers the Basic Healthcare Sum, ensuring financial security for medical expenses.

In summary, the Enhanced Retirement Sum in Singapore is a crucial aspect of retirement planning.

It impacts the monthly income individuals can expect through CPF Life payouts and determines the savings necessary to hit the FRS or ERS.

By understanding the different CPF accounts and planning accordingly, individuals can secure a comfortable retirement and enjoy financial stability during their golden years.

Ultimately, individuals should carefully assess their current CPF savings, projected needs, and desired retirement lifestyle.

Consulting with the CPF Board or a financial advisor can provide personalized guidance to make informed decisions about the Full Retirement Sum and Enhanced Retirement Sum that best suits their circumstances.

Frequently Asked Questions

What is the enhanced retirement sum?

The enhanced retirement sum (ERS) is a higher retirement sum available for individuals who wish to have a higher payout during their retirement years.

It is a sum of money in your CPF retirement account that you can withdraw from when you turn 55 years old.

How does the enhanced retirement sum differ from the basic retirement sum?

The basic retirement sum (BRS) is the minimum sum required in your CPF retirement account when you turn 55 years old.

The ERS, on the other hand, is a higher sum that you can choose to have in your retirement account for a higher monthly payout when you retire.

Can I choose not to have an enhanced retirement sum?

Yes, you can choose not to have an ERS.

If you do not select the ERS, your retirement account will have the BRS by default.

How much is the enhanced retirement sum?

The ERS is three times the amount of the BRS.

For example, if the BRS is $90,000, the ERS will be $270,000.

Does the ERS increase every year?

Yes, the ERS increases every year to account for inflation and to ensure that your retirement payout maintains its purchasing power.

When can I withdraw money from my CPF retirement account?

You can choose to start withdrawing money from your CPF retirement account when you turn 55 years old.

How does the enhanced retirement sum affect my retirement?

Having an ERS in your retirement account will provide you with a higher monthly payout when you retire.

This can help you maintain a higher standard of living during your retirement years.

Can I withdraw more than the ERS from my CPF Basic retirement account?

Yes, you can withdraw any sums in excess of the ERS from your CPF retirement account.

However, it is essential to note that these withdrawals will reduce the amount of money available for your monthly payouts.

What happens if I do not have enough money in my CPF retirement account to meet the ERS?

If you do not have enough money in your CPF retirement account to meet the ERS, you can choose to top up the shortfall with your CPF Ordinary Account (OA) savings or cash.

Alternatively, you can also choose to form your retirement account using your Special Account (SA) savings.

How are the CPF payouts calculated, BRS, and FRS?

The CPF payouts are calculated based on the amount of money in your CPF retirement account at age 55, the BRS or ERS you have chosen, and the CPF interest rates.

The payouts are designed to provide you with monthly income during your retirement years.