Buying a property is a significant milestone in many people’s lives and provides a sense of stability and a place to call home.

However, circumstances change, and there may be situations where you need to consider adding a co-owner to your HDB flat.

In this article, we will explore the eligibility requirements, financial considerations, legal documents, procedures for inheritance, and relevant government agencies involved in the process of adding a co-owner to an HDB flat.

Key Takeaways

| Key Takeaway | Explanation |

|---|---|

| HDB Flat Ownership | HDB flat ownership refers to the legal rights and responsibilities individuals hold over a specific HDB flat. |

| Role of Development Board (HDB) | HDB plays a crucial role in overseeing the planning, development, and management of public housing in Singapore. |

| Eligibility for Adding a Co-Owner | Eligibility for adding a co-owner includes spouses, certain family members, and transferring ownership to children for divorcees. |

| Conditions for Adding a Co-Owner | The process requires deciding on joint tenancy or tenancy-in-common, meeting HDB eligibility criteria, and potential monetary considerations. |

| Restrictions on Co-Owners | Certain restrictions prevent private property owners from being co-owners of an HDB flat. Flat ownership without monetary consideration may have limitations. |

| Types of Ownership Changes for HDB Flats | Owners can add co-owners, sell the flat, or transfer ownership to eligible parties. |

| Choosing the Right Ownership Change Option | Selecting the right option depends on financial goals, family situation, and long-term plans. Professional advice is recommended. |

| Joint Tenancy vs. Tenancy-in-Common Scheme | The joint tenancy offers equal shares and automatic inheritance, while tenancy-in-common allows different ownership proportions. |

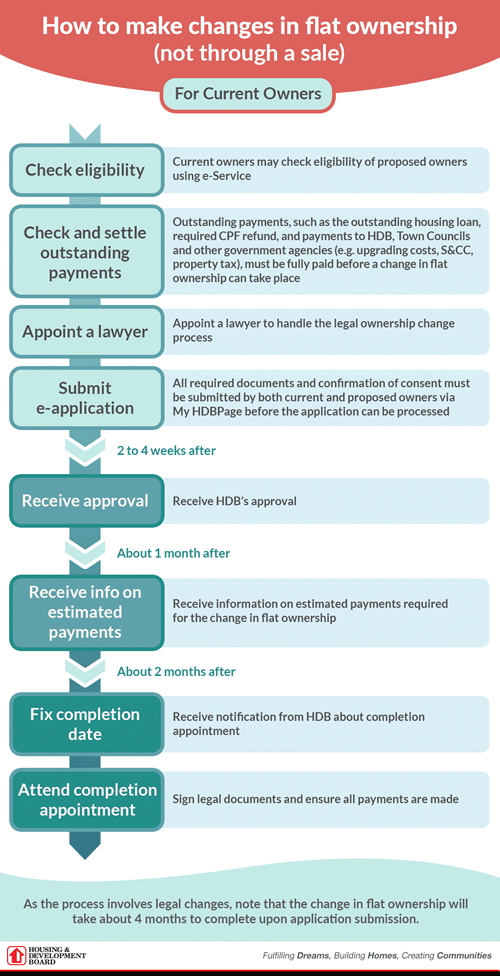

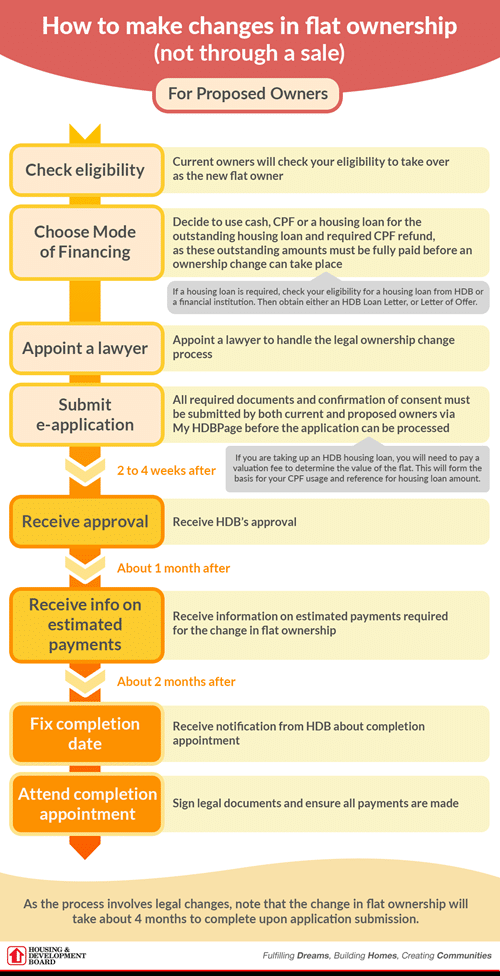

| Step-by-Step Process for Adding a Co-Owner | The process involves eligibility checks, application submission, awaiting approval, agreement execution, and updating records. |

| Timeline for Adding a Co-Owner | The process usually takes several weeks, but it can vary based on complexity and agency workload. |

| Documents Required for Adding a Co-Owner | Proof of identity, relationship, eligibility, and additional documents as needed for the application. |

| Eligibility Reassessment for Co-Ownership | Reassessment is necessary to ensure all eligibility requirements are met when adding a co-owner. |

| Financial Considerations for Co-Ownership | Co-owners must meet specific financial eligibility criteria and calculate monetary considerations for a fair distribution. |

| Legal Documents for HDB Co-Ownership | Essential legal documents include property plans, conveyancing forms, and consent from existing joint owners. |

| Inheritance and Deceased Owner’s Share | Procedures for transferring ownership after the death of an owner and distribution of their share among co-owners. |

| Government Agencies and Official Websites | Reputable government websites provide valuable resources and guidelines for HDB co-ownership procedures. |

| Role of Lawyers in HDB Flat Ownership Transactions | Lawyers play a vital role in reviewing agreements, conducting title searches, and providing legal assistance in transactions. |

| Conveyancing Procedure and Fees for Co-Ownership | The conveyancing process involves several steps, and fees vary based on complexity and services provided by the lawyer. |

| Guidelines for Building Works in HDB Flats | HDB has rules and regulations for building works to ensure structural integrity and residents’ safety. |

| Financing Your HDB Flat | Buyers can finance their HDB flat purchase through mortgage loans and CPF savings, meeting specific eligibility criteria. |

| Maintenance and Responsibilities of Co-Owners | Co-owners must fulfill maintenance responsibilities, share expenses, and address non-compliance issues. |

| Future Property Plans and Appreciation in Value | Co-owners should plan future investments based on financial capabilities, goals, market conditions, and property factors. |

| Official Links and Resources for Informed Choices | Official HDB and government websites provide valuable information on various aspects of HDB flat ownership. |

Understanding HDB Flat Ownership and Development Board (HDB)

HDB flat ownership in Singapore is regulated by the Development Board (HDB), a government agency responsible for public housing.

HDB flats are highly sought after due to their affordability and the comprehensive range of facilities and amenities provided within HDB estates.

What is HDB flat ownership?

HDB flat ownership refers to the legal rights and responsibilities that an individual or a group of individuals hold over a specific HDB flat.

When you own an HDB flat, you have the right to occupy the property and enjoy the benefits that come with it, such as access to common facilities and services provided by HDB.

What is the role of the Development Board (HDB) in flat

ownership?

The Development Board (HDB) plays a crucial role in the ownership of HDB flats.

They oversee the planning, development, and management of public housing in Singapore.

HDB ensures that the buying, selling, and transferring of HDB flats are carried out in a legal and regulated manner for the benefit of flat owners and the community as a whole.

Eligibility Conditions for Adding a Co-Owner to Your HDB Flat

If you currently own an HDB flat and wish to add a co-owner, there are certain eligibility conditions that must be met.

These conditions vary depending on your relationship with the intended co-owner.

Who is eligible to add a co-owner to their HDB flat?

In general, the eligibility criteria for adding a co-owner to an HDB flat is as follows:

- Spouse: If you are legally married, you can add your spouse as a co-owner of your HDB flat.

- Family Member: You can add certain family members, such as parents, children, or siblings, as co-owners of your HDB flat under specific circumstances.

- Divorcee: If you are a divorcee and wish to transfer your HDB flat ownership to your children, you can add them as co-owners.

What are the conditions for adding a co-owner to an

HDB flat?

Adding a co-owner to your HDB flat requires careful consideration and adherence to certain conditions:

- Manner of Holding: You have to decide on the manner of holding for the co-ownership.

- The two options available are joint tenancy and tenancy-in-common scheme.

- Eligibility Criteria: The co-owner must meet the eligibility criteria set by HDB, including citizenship, age, and income requirements.

- Monetary Consideration: There may be a monetary consideration involved when adding a co-owner, such as the payment of a share of the flat’s value.

Are there any restrictions on who can be added as a co-owner?

HDB has certain restrictions on who can be added as a co-owner of an HDB flat:

- Private Property Owners: If the intended co-owner already owns private property, they may not be eligible to be added as a co-owner of an HDB flat.

- Flat Ownership Without Monetary Consideration: In some cases, flat owners may transfer ownership without any monetary consideration, for example, as a gift or inheritance.

- However, certain conditions and limitations apply.

Types of Ownership Changes for HDB Flats: Choosing the Right Option

When it comes to changing the ownership of HDB flats, there are different options available to flat owners.

It is important to choose the option that best suits your needs and circumstances.

What are the different types of ownership changes for HDB flats?

The different types of ownership changes for HDB flats include:

- Adding Co-Owner: This involves adding a new co-owner to the existing ownership of the HDB flat.

- Selling the Flat: You can sell your HDB flat to another eligible buyer.

- Transfer of Flat Ownership: Transferring the flat ownership to another eligible party, such as family members.

How do you choose the right ownership change option for your HDB flat?

Choosing the right ownership change option for your HDB flat depends on various factors, such as your financial goals, family situation, and long-term plans.

It is advisable to seek professional advice from a lawyer or a housing agent to understand the implications and requirements of each option.

Joint Tenancy vs. Tenancy-in-Common Scheme: Which One Fits Your Needs?

When adding a co-owner to your HDB flat, you need to decide on the manner of holding, either a joint tenancy or tenancy-in-common scheme.

Both options have distinct features and implications.

What is the difference between joint tenancy and tenancy-in-common scheme?

In joint tenancy, all co-owners have an equal share in the flat and, in the event of the death of one co-owner, the remaining co-owners automatically inherit their share.

In contrast, a tenancy-in-common scheme allows co-owners to hold different proportions of ownership, and their shares can be inherited according to their will.

Which ownership scheme is more suitable for your needs?

The choice between joint tenancy and tenancy-in-common scheme depends on your specific needs and circumstances.

Joint tenancy is commonly chosen by married couples who wish to have equal ownership and succession rights, while a tenancy-in-common scheme is preferred when co-owners hold unequal shares or want to have more flexibility in estate planning.

Step-by-Step Process: How to Add a Co-Owner to Your HDB Flat

If you have decided to add a co-owner to your HDB flat, here is a step-by-step process to guide you:

What are the steps involved in adding a co-owner to your

HDB flat?

- Check Eligibility: Ensure that both you and the intended co-owner meet the eligibility criteria set by HDB.

- Submit Application: Prepare and submit the necessary application form and supporting documents to HDB.

- Wait for Approval: Await HDB’s approval, which may take several weeks.

- Execute Agreement: Once the application is approved, both you and the co-owner must sign an agreement to signify the change in ownership.

- Update Ownership Records: Notify HDB and other relevant government agencies of the change in ownership and update records accordingly.

How long does the process usually take?

The process of adding a co-owner to an HDB flat typically takes several weeks to complete.

However, the exact timeline may vary depending on various factors, such as the complexity of the application and the workload of HDB and other agencies involved.

Are there any documents required for adding a co-owner to

an HDB flat?

Yes, there are certain documents that you need to submit when applying to add a co-owner to your HDB flat.

These documents may include:

- Proof of Identity: Identification documents of both the existing owner and the intended co-owner, such as NRIC or passport.

- Proof of Relationship: Documents to prove the relationship between the existing owner and the intended co-owner, such as a marriage certificate or birth certificate.

- Proof of Eligibility: Supporting documents to prove eligibility, such as income statements or divorce papers.

- Other Supporting Documents: Additional documents as required by HDB to process the application.

Adding a co-owner to your HDB flat is a significant decision that requires careful consideration and adherence to the necessary procedures.

It is advisable to consult HDB and seek professional advice to ensure a smooth and legal transition of ownership.

Eligibility Reassessment and Considerations for Co-Ownership Approval

Eligibility requirements for adding a co-owner

Before proceeding with the addition of a co-owner, it is crucial to determine if you meet the eligibility requirements set by the government.

The eligibility requirements include factors such as citizenship, age, and family nucleus.

Only certain individuals are eligible to become co-owners of an HDB flat, and it’s essential to understand these criteria to avoid any issues in the future.

Impact of co-ownership on resale eligibility

Adding a co-owner to your HDB flat may have implications on your resale eligibility.

It is essential to understand the impact of co-ownership on the eligibility criteria set by the HDB for resale flats.

This includes considering factors such as the prevailing loan ceiling and whether the co-owner has previously enjoyed any housing grants.

These factors can influence your eligibility to sell your flat in the future.

Procedure for reassessing eligibility for co-ownership

When adding a co-owner to your HDB flat, there is a procedure for reassessing your eligibility.

This involves submitting the necessary documentation and going through an assessment process by the HDB.

The procedure ensures that all eligibility requirements are met and that the addition of the co-owner aligns with the rules and regulations set by the HDB.

Financial Considerations and Monetary Considerations in HDB Co-Ownership

Financial eligibility criteria for co-ownership

Co-ownership of an HDB flat entails financial considerations.

The co-owner must meet specific financial eligibility criteria to ensure they can adequately contribute to the ownership and maintenance of the flat.

This includes factors such as income, outstanding loans, and employment status.

Calculating the monetary consideration for adding a co-

owner

When adding a co-owner, there is a monetary consideration involved.

This calculation takes into account factors such as the share of ownership and the financial contributions made by each party.

It is important to accurately assess this amount to ensure a fair distribution of costs and responsibilities.

Impact of co-ownership on outstanding loan amount

Adding a co-owner to an HDB flat may have implications on the outstanding loan amount.

The co-owner’s financial standing and obligations will impact the loan payments and the overall financial commitment of the property.

It is crucial to consider these factors before proceeding with the addition of a co-owner.

Essential Legal Documents for HDB Flat Co-Ownership: What You Need to Know

List of essential legal documents for adding a co-owner

Changing the ownership status of an HDB flat requires essential legal documents.

These documents include the existing property plans, conveyancing procedure forms, and consent from existing joint owners.

It is important to ensure that all necessary documents are prepared and submitted correctly to facilitate a smooth ownership transfer.

Conveyancing procedure for changing the ownership status

The conveyancing procedure is a crucial step in changing the ownership status of an HDB flat.

It involves the legal transfer of the property from the outgoing owner to the new co-owner.

It is advisable to engage the services of a qualified conveyancing lawyer to ensure that all legal requirements are met during this process.

Obtaining consent from existing joint owners

If there are existing joint owners, their consent is required when adding a co-owner to an HDB flat.

It is crucial to obtain their consent before proceeding with the ownership transfer.

Open communication and clear documentation are necessary to ensure a smooth transition and maintain positive relationships with the current owners.

Inheritance and Dealing with Deceased Owner’s Share in an HDB Flat

Procedures for transferring ownership in case of a deceased

owner

In the unfortunate event of a deceased owner, there are specific procedures for transferring ownership of the HDB flat.

These procedures involve applying for a change in ownership and submitting the necessary legal documents to the HDB.

It is advisable to seek legal advice and assistance during this process to ensure a smooth transfer of ownership.

Distribution of deceased owner’s share among joint owners

Upon the passing of an owner, the distribution of their share among the joint owners must be determined.

The HDB has guidelines and procedures in place for this situation, ensuring a fair and proper distribution of the property’s ownership shares.

Legal implications and documentation required for

inheritance

Inheritance of an HDB flat involves legal implications and requires specific documentation.

To ensure a smooth transfer of ownership and to comply with legal requirements, it is advisable to consult with legal professionals who specialize in property law.

Government Agencies and Official Websites for HDB Co-Ownership Procedures

Relevant official websites for HDB co-ownership procedures

When dealing with HDB co-ownership procedures, it is essential to refer to official websites for accurate and up-to-date information.

The HDB and government websites provide valuable resources and guidelines for individuals seeking to add a co-owner to their HDB flat.

Government agencies involved in managing HDB co-

ownership

Various government agencies are involved in managing HDB co-ownership.

These agencies play a crucial role in assessing eligibility, facilitating ownership transfers, and providing guidance throughout the process.

It is important to be aware of these agencies and their role in order to navigate the procedures smoothly.

Secure websites for online submission of necessary

documents

When submitting necessary documents for HDB co-ownership procedures, it is vital to use secure websites for online submission.

This added precaution ensures the safety and confidentiality of sensitive information.

Official secure websites typically have an “https” protocol to indicate a secure connection.

It is important to share sensitive information only on official and secure platforms.

The Role of Lawyers in HDB Flat Ownership Transactions: Why You Might Need One

When it comes to buying or selling a residential property, particularly an HDB flat, it is important to ensure that all legal matters are properly addressed.

This is where the role of lawyers comes into play.

Lawyers specializing in HDB flat ownership transactions can provide valuable assistance throughout the entire process, ensuring that all necessary legal documents are prepared and all legal requirements are met.

How can a lawyer assist in HDB flat ownership transactions?

A lawyer can review the terms and conditions of the sales agreement, ensuring that your interests as a buyer or seller are protected.

They can also conduct a thorough title search to verify the ownership and any encumbrances on the property.

In addition, a lawyer can assist with the drafting and execution of important documents such as the Option to Purchase and Sale & Purchase Agreement.

What are the benefits of hiring a lawyer?

Hiring a lawyer for HDB flat ownership transactions offers several benefits.

Firstly, it provides you with peace of mind, knowing that all legal matters are taken care of professionally.

A lawyer can help you navigate complex legal issues and ensure that your rights and interests are protected throughout the transaction.

They can also provide valuable advice on matters such as financing options, eligibility criteria, and co-ownership issues.

What legal documents are involved in HDB flat ownership

transactions?

There are several legal documents involved in HDB flat ownership transactions.

These include the Option to Purchase, which is a contract granting the buyer the right to purchase the property within a specified period of time.

The Sale & Purchase Agreement is another important document, which sets out the terms and conditions of the sale.

Other documents may include the Mortgage Loan Agreement, CPF Withdrawal Form, and various statutory declarations.

Conveyancing Procedure and Fees for Co-Ownership of HDB Flats

What is the conveyancing procedure for co-ownership of HDB

flats?

When it comes to co-ownership of HDB flats, the conveyancing procedure involves several steps.

Firstly, both parties must agree on the terms of co-ownership and appoint a lawyer to handle the transaction.

The lawyer will then prepare the necessary legal documents, including the Deed of Co-Ownership, which sets out the rights and responsibilities of each co-owner.

Once the documents are ready, they will be executed and registered with the Singapore Land Authority.

What fees are involved in the conveyancing process?

The fees involved in the conveyancing process for the co-ownership of HDB flats may vary depending on the complexity of the transaction and the services provided by the lawyer.

Common fees include legal fees, stamp duty, and registration fees.

It is important to discuss the fees with your lawyer upfront and ensure that you have a clear understanding of all costs involved.

Are there any guidelines for building works in HDB flats?

Yes, there are guidelines for building works in HDB flats.

The HDB has set out specific rules and regulations regarding building works to ensure the structural integrity of the flats and the safety of the residents.

Before carrying out any building work, it is important to obtain the necessary permits and approvals from the relevant authorities.

Failure to comply with the guidelines can result in penalties and legal consequences.

Financing Your HDB Flat: Mortgage Loans, CPF, and Eligibility Criteria

How can you finance your HDB flat purchase?

There are several ways to finance your HDB flat purchase.

One option is to obtain a mortgage loan from a financial institution.

To be eligible for a mortgage loan, you must meet certain criteria, such as having a stable income and a good credit history.

Another option is to use your CPF savings to finance the purchase.

The CPF scheme allows eligible buyers to use their CPF savings for the down payment and monthly mortgage payments.

What are the eligibility criteria for obtaining a mortgage

loan?

The eligibility criteria for obtaining a mortgage loan may vary among financial institutions.

Generally, they will assess factors such as your income, credit history, and ability to repay the loan.

They may also take into account the age and remaining lease of the HDB flat.

It is important to carefully review the eligibility criteria of different lenders and choose the one that best suits your financial situation.

How does the CPF scheme work for HDB flat buyers?

The CPF scheme is a government initiative that allows eligible buyers to use their CPF savings to finance the purchase of an HDB flat.

Buyers can use their CPF savings for the down payment, monthly mortgage payments, and other related costs such as legal fees and stamp duty.

It is important to note that there are limits on the amount of CPF savings that can be used and certain conditions that must be met.

Maintenance and Responsibilities of Co-Owners in an HDB Flat

What are the maintenance responsibilities of co-owners in an

HDB flat?

As co-owners of an HDB flat, it is important to understand and fulfill your maintenance responsibilities.

These include regular upkeep of the flat, such as cleaning and repairs.

Co-owners are also responsible for the payment of maintenance fees and other shared expenses, such as property taxes and insurance premiums.

It is important to establish clear communication and a system for managing shared expenses to avoid conflicts.

How can co-owners effectively manage shared expenses?

Managing shared expenses among co-owners can be challenging, but with proper planning and communication, it can be done effectively.

One option is to establish a joint bank account for the purpose of managing shared expenses.

This allows for transparency and ease of payment.

It is also important to set a budget and agree on the allocation of expenses among co-owners.

Regular discussions and open communication are key to successful expense management.

What happens if one co-owner fails to fulfill their

responsibilities?

If one co-owner fails to fulfill their responsibilities, it can cause problems within the co-ownership arrangement.

The other co-owners may need to take action to address the issue, such as reminding the responsible party of their obligations or seeking legal advice.

In extreme cases, it may be necessary to explore alternative solutions, such as selling the property or seeking a court order to resolve the matter.

Future Property Plans and Appreciation in Value: Making Informed Choices as Co-Owners

How can co-owners plan for future property investments?

Co-owners can plan for future property investments by considering factors such as their financial capabilities, investment goals, and market conditions.

It is important to conduct thorough research and seek professional advice before making any investment decisions.

Co-owners should also discuss their long-term plans and expectations to ensure that they are aligned and can make informed choices together.

What factors should be considered when assessing the

appreciation in value of an HDB flat?

When assessing the appreciation in the value of an HDB flat, several factors should be considered.

These include the location of the flat, the surrounding amenities and infrastructure, the demand and supply dynamics in the market, and any future developments in the area.

It is also important to stay informed about government policies and initiatives that may impact the value of the property.

Are there any official links or resources available for co-

owners to make informed choices?

Yes, there are official links and resources available for co-owners to make informed choices.

The HDB website and government websites such as gov.

sg provide valuable information on HDB flat ownership, eligibility schemes, financing options, and other relevant topics.

It is advisable to consult these official sources and seek professional advice when making important decisions regarding your HDB flat.

Conclusion

In conclusion, understanding HDB flat ownership and the role of the Development Board (HDB) in Singapore is essential for prospective homeowners.

Owning an HDB flat comes with rights and responsibilities, and adding a co-owner requires careful consideration and adherence to eligibility criteria.

Choosing the right ownership change option, whether adding a co-owner, selling the flat, or transferring ownership, depends on individual needs and circumstances.

When adding a co-owner, deciding between joint tenancy and tenancy-in-common scheme is crucial and depends on co-owners preferences and estate planning goals.

The step-by-step process for adding a co-owner involves checking eligibility, submitting the application, awaiting approval, executing an agreement, and updating ownership records.

Co-ownership approval entails reassessing eligibility and considering financial factors and monetary considerations.

It’s also essential to be aware of legal documents, government agencies, and secure websites for smooth co-ownership transactions.

The role of lawyers is vital in HDB flat ownership transactions to ensure all legal matters are addressed properly.

Conveyancing procedures, fees, and guidelines for building works in HDB flats should be well understood to avoid issues.

Financing options, such as mortgage loans and CPF usage, help make HDB flat purchases more accessible.

Co-owners should also be aware of their maintenance responsibilities and effective ways to manage shared expenses.

Planning for future property investments and assessing the appreciation in value require considering various factors and utilizing official resources and links for informed choices.

Frequently Asked Questions

What is the process to add a co-owner to an HDB flat?

To add a co-owner to your HDB flat, you need to fulfill certain eligibility criteria.

You can find the application procedure on the HDB website.

The process involves submitting an application and providing the necessary documents.

Who is eligible to be added as a co-owner?

Immediate family members such as your spouse, parents, or children can be added as co-owners.

However, there are certain eligibility requirements that need to be met.

You can refer to HDB’s eligibility schemes for more information.

Can I add a co-owner to my HDB flat if I am still repaying my mortgage loan?

Yes, it is possible to add a co-owner even if you have an existing mortgage loan.

However, both you and the proposed co-owner will need to be involved in the transaction and fulfill the necessary requirements.

What happens in the event of the demise of an owner?

In the unfortunate event of an owner’s demise, the share of the flat will be transferred to the remaining owners according to the existing ownership arrangement.

The process of transferring ownership will involve the necessary legal procedures.

Can I change the ownership of my HDB flat if I am planning to retire and move out?

Yes, you can change the ownership of your HDB flat if you are planning to retire and move out.

However, the new owners must fulfill the eligibility criteria set by HDB.

Does HDB allow co-owning a flat with someone who is not a family member?

No, HDB allows only immediate family members to be co-owners of a flat.

Co-owning with someone who is not a family member is not permitted.

What does the change in flat ownership involve?

The change in flat ownership involves transferring the legal rights and ownership of the flat to the new owners.

The existing owners will no longer have ownership rights, and the new owners will become the legal owners of the flat.

How can I apply for a change in flat ownership?

You can apply for a change in flat ownership by following the application procedure provided by HDB.

The necessary forms and documents need to be submitted, and the application will be processed by HDB.

Is there any cost involved in changing the ownership of an HDB flat?

There may be some costs involved in changing the ownership of an HDB flat.

These costs may include legal fees, administrative fees, and other charges.

You can find more information on the HDB website.

Can I change the co-owners of my HDB flat more than once?

Yes, you can change the co-owners of your HDB flat more than once.

However, there may be certain restrictions or conditions imposed by HDB.

It is advisable to check with HDB directly for more information.