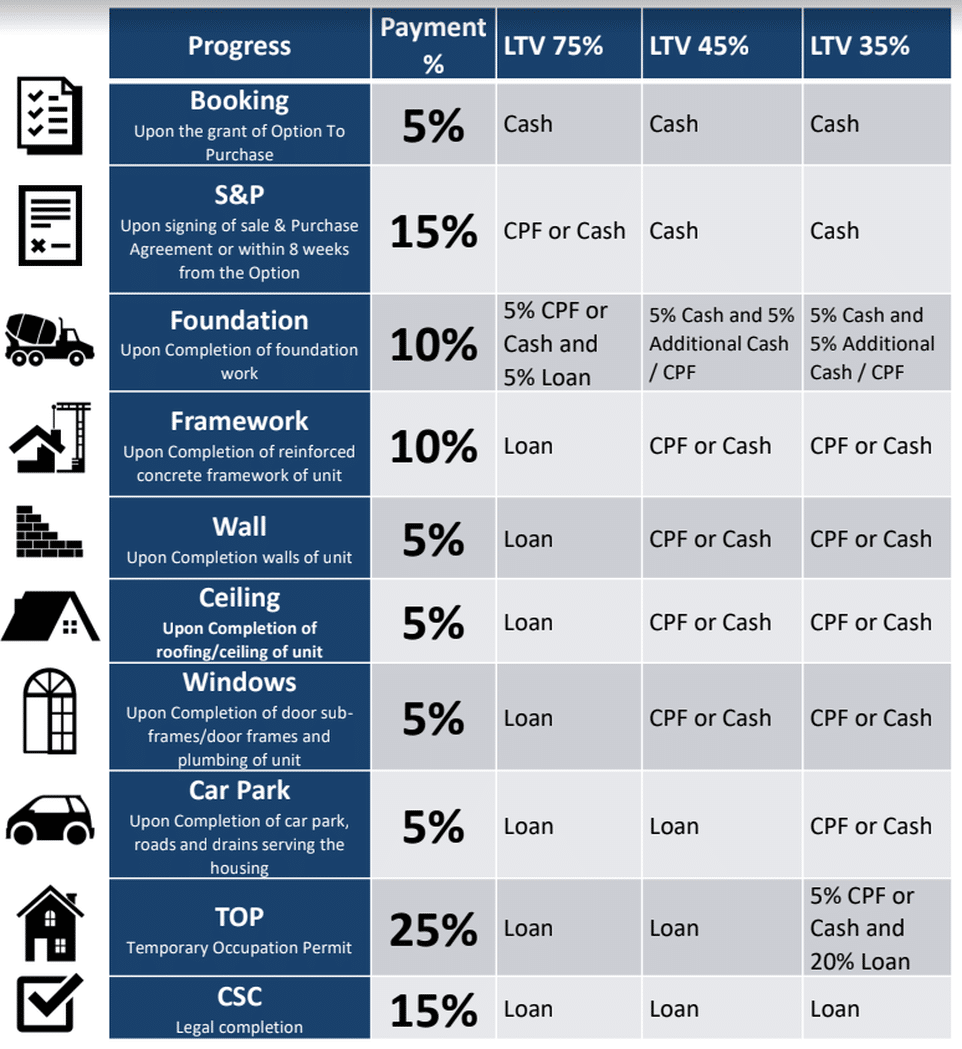

| Stage | % | Description | When to Get Ready | Payment Mode |

| 1st | 5% | Booking & Obtaining Option To Purchase | Day 1 | Cash |

| Buyer to engage a solicitor (~ $3000) Buyer to select the Mortgage Loan (Stamp fee ~$500) |

ASAP | Cash or CPF OA | ||

| Buyer’s Stamp Duty | Within two weeks upon signing S&P | Cash or CPF OA | ||

| Additional Buyer’s Stamp Duty | Within two weeks upon signing S&P | Cash or CPF OA | ||

| 15% | Downpayment | Within eight weeks from Date of Option | Cash or CPF OA | |

| 2nd | 5% | Completion of Foundation Work 完成地基 |

Cash or CPF OA | |

| 5% | Bank Loan | |||

| 3rd | 10% | Completion of Reinforced Concrete 完成三合土框 |

Bank Loan | |

| 4th | 5% | Completion of Brick Wall 完成砖墙 |

Bank Loan | |

| 5th | 5% | Completion of Ceiling / Roofing 完成天花板/屋顶 |

Bank Loan | |

| 6th | 5% | Completion of Doors & Windows Frames are in position, the Electrical Wiring & Plumbing & Internal Plastering 完成门/窗框,电线,水管及内部抹灰 |

Bank Loan | |

| 7th | 5% | Completion of Car Park, Roads and Drains 完成停车场道路与水渠 |

Bank Loan | |

| 8th | 25% | Obtaining Temporary Occupation Permit (TOP) 取得临时居住许可证 |

Bank Loan | |

| 9th | 15% | Upon Production of the Certificate of Statutory Completion (CSC) 取得法定完工证书 |

Bank Loan | |

Dive into the dynamic realm of Singapore’s Progressive Payment Scheme.

As you navigate the path of property acquisition, imagine paying for your dream condo step by step – from foundation to finishing touches.

This structured approach ensures transparency and financial finesse.

Brace yourself for a captivating journey where financial wisdom meets real estate adventure.

Key Takeaways

- PPS Overview: The Progressive Payment Scheme (PPS) facilitates payment for new launch condos in Singapore, allowing buyers to make payments at various construction stages.

- Structured Financing: PPS provides a structured approach to financing, enabling buyers to monitor construction progress and ensure transparency.

- Timeline and Stages: PPS timelines vary; it encompasses stages such as booking, Sales and Purchase Agreement (S&PA), construction milestones, and Notice of Completion.

- Installment Calculation: Installments are calculated as a percentage of the purchase price, outlined in the purchase agreement.

- HDB and BUC Roles: HDB oversees guidelines, while Building Under Construction (BUC) ensures construction quality and receives payments.

- Benefits: PPS benefits buyers with lower initial repayments, flexibility, and potential for capital appreciation.

- Managing Loan Repayments: Coordination with financial institutions helps buyers manage loan repayments alongside PPS stages.

- Resale Condos and PPS: PPS also applies to resale condos, aiding buyers in managing cash flow and payment obligations.

- Singaporean Citizens: Citizens enjoy eligibility for housing loans and potential government incentives under PPS.

- Technological Impact: Technological advancements enhance PPS accessibility for local, mobile, and e-commerce buyers.

Understanding the Progressive Payment Scheme in Singapore

What is the Progressive Payment Scheme?

The progressive payment scheme, also known as PPS, is a payment schedule for purchasing new launch condos in Singapore.

It allows buyers to make payments at various stages of the construction process.

How does the Progressive Payment Scheme work for new launch condos?

Under the progressive payment scheme, buyers are required to make payments based on the completion of specific stages of development.

These stages can include milestones such as the completion of the foundation, the installation of window frames, or the internal plastering of the unit.

Why is the Progressive Payment Scheme important for buyers?

The progressive payment scheme is important for buyers as it provides a structured approach to financing their property purchase.

It allows them to monitor the progress of the construction and make payments accordingly, ensuring transparency and accountability throughout the process.

How the Progressive Payment Scheme Works for New Launch Condos

What is the timeline for the Progressive Payment Scheme?

The timeline for the progressive payment scheme varies depending on the specific development and the stages of construction.

Generally, the payment schedule begins with a booking fee and extends until the completion of the project.

What are the stages of the Progressive Payment Scheme?

The progressive payment scheme consists of several stages, including the booking fee, the signing of the Sales and Purchase Agreement (S&PA), and various milestones of construction completion.

How are installments calculated under the Progressive Payment Scheme?

Installments under the progressive payment scheme are typically calculated based on a percentage of the purchase price.

The specific percentage for each stage is outlined in the purchase agreement.

The Timeline for Progressive Payment Scheme and Its Stages

What are the stages of the Progressive Payment Scheme?

The stages of the progressive payment scheme typically include the booking fee, signing of the S&PA, the completion of key milestones during the construction process, and the issuance of the Notice of Completion.

What are the key milestones during the payment schedule?

Key milestones during the payment schedule can include the completion of the foundation, the structural completion, the installation of the electrical wiring, and the issuance of the Temporary Occupation Permit (TOP).

What happens if the developer is late in completing a stage?

If the developer is late in completing a stage, buyers may be entitled to compensation or alternative arrangements as stipulated in the purchase agreement.

It is important for buyers to review the terms and conditions of the agreement to understand their rights in such situations.

Exploring the Payment Schedule for Buying New Launch Condos

What are the payment milestones for buying a new launch condo?

The payment milestones for buying a new launch condo typically include the booking fee, down payment, progressive payments based on the stages of construction, and the final payment upon completion of the project.

What are the additional costs involved in the payment schedule?

In addition to the purchase price, buyers need to be aware of other costs involved in the payment schedule, such as the Buyer’s Stamp Duty (BSD), Additional Buyer’s Stamp Duty (ABSD), and legal fees.

These costs should be factored into the overall budget when purchasing a new launch condo.

How can buyers manage loan repayments in conjunction with the Progressive Payment Scheme?

Buyers can manage loan repayments in conjunction with the progressive payment scheme by coordinating with their financial institution and ensuring that they have the necessary funding available at each stage of the payment schedule.

It is important to plan ahead and communicate with the lender to avoid any potential financial challenges.

Managing Loan Repayments in Conjunction with Progressive Payment Scheme

How does the Progressive Payment Scheme affect home loan applications?

It is important for buyers to maintain a good credit history and provide the necessary documents for loan approval.

Can CPF be used to pay for the property under the Progressive Payment Scheme?

Yes, buyers can utilize their Central Provident Fund (CPF) savings to pay for the property under the progressive payment scheme.

However, there are certain conditions and limitations on the usage of CPF funds, and buyers should consult with the relevant authorities for detailed information.

What are the stamp duties and other charges involved in the payment schedule?

In addition to the purchase price, buyers need to consider the stamp duties involved in the payment schedule, such as the Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD).

These charges are calculated based on the purchase price of the property and the buyer’s residential status.

The Role of HDB and BUC in the Progressive Payment Scheme

When it comes to the Progressive Payment Scheme, both HDB and BUC play essential roles in ensuring its smooth implementation.

What is the role of HDB in the Progressive Payment Scheme?

HDB, which stands for Housing and Development Board, oversees the development of public housing in Singapore.

In the case of the PPS, HDB sets the guidelines and regulations for the payment schedule.

They ensure that the schedule is fair for both buyers and developers and that the payments are made at each stage of the construction progress.

What is the role of BUC in the Progressive Payment Scheme?

BUC, which stands for Building Under Construction, refers to the development that is still in progress.

The BUC represents the developer who is responsible for completing the condo unit and ensuring its quality.

In the PPS, the BUC receives progressive payments from the buyers at each stage of the construction.

How do HDB and BUC contribute to the smooth implementation of the scheme?

The roles of HDB and BUC are intertwined in the PPS.

HDB ensures that the payment schedule is followed according to the guidelines, while BUC receives the payments and ensures the construction progress is on track.

This coordination between the two entities helps in the smooth implementation of the PPS, providing assurance to both buyers and developers.

Key Milestones in the Condo Payment Schedule under PPS

The payment schedule for condos under the Progressive Payment Scheme consists of several stages that signify the progress of the construction.

Let’s take a closer look at the key milestones in the payment schedule:

What are the key milestones in the payment schedule for condos under the Progressive Payment Scheme?

The payment schedule for condos typically includes milestones such as the completion of foundation work, concrete framework, completion of brick walls, completion of partition walls, completion of roofing, completion of the ceiling, completion of carpark, and the fulfillment of other essential components of the building.

What does the completion of the foundation work signify in the payment schedule?

The completion of the foundation work is a crucial milestone in the payment schedule.

It signifies the initial stage where the condo’s structure begins to take shape.

At this point, the buyer is required to make the first payment installment for the condo unit.

What are the next steps after the completion of the roofing in the payment schedule?

After the completion of the roofing, the construction progresses toward the interior works, including the completion of brick walls, partition walls, and ceilings.

Each of these stages will require the buyer to pay the developer one more installment until the development is completed.

Ensuring a Smooth Start of Monthly Loan Repayments for New Condos

Once the condo is completed, buyers will need to start repaying their mortgage through monthly installments.

Here are some tips to ensure a smooth start of monthly loan repayments for new condos:

How can buyers ensure a smooth start of monthly loan repayments for new condos?

To ensure a smooth start of monthly loan repayments, buyers should plan their finances in advance.

It is advisable to set aside a portion of their savings for the down payment and initial financial commitments.

This will help them stay on track with their repayments and avoid any financial strain in the early stages of homeownership.

What factors should buyers consider before taking up a bank loan for their condo purchase?

Before taking up a bank loan for their condo purchase, buyers should consider factors such as interest rates, repayment period, and terms and conditions.

It is essential to compare loan offers from different banks and choose the one that suits their financial situation and long-term plans.

Consulting with a mortgage advisor can also provide valuable insights.

What are the advantages of opting for the Progressive Payment Scheme for monthly loan repayments?

Opting for the Progressive Payment Scheme brings several advantages for buyers in terms of cash flow management.

With PPS, buyers can enjoy lower initial monthly repayments compared to a traditional mortgage loan.

The payments increase progressively as the construction stages are completed, allowing buyers to manage their finances more effectively.

Stage 1 of the Progressive Payment Scheme: A Critical Milestone

Stage 1 of the Progressive Payment Scheme holds significant importance in the payment schedule.

Let’s delve into the details of this critical milestone:

What is Stage 1 of the Progressive Payment Scheme and why is it considered a critical milestone?

Stage 1 of the Progressive Payment Scheme is the initial stage, where buyers pay a 5% fee in cash upon the grant of option (OTP) for the condo unit.

This stage signifies the commitment of the buyer toward the purchase and is considered a critical milestone in the payment schedule.

What are the various components of Stage 1 in the payment schedule?

Stage 1 consists of signing the Sale and Purchase Agreement (S&PA), paying the OTP fee within 14 days from the date of the grant, and making the first payment installment for the condo unit.

These components mark the beginning of the buyer’s financial journey in the PPS.

What are the consequences if a buyer fails to make the payment for Stage 1 within the specified timeframe?

If a buyer fails to make the payment for Stage 1 within the specified timeframe, there may be penalties such as losing the OTP or incurring additional charges.

It is crucial for buyers to adhere to the payment schedule and fulfill their financial obligations to avoid any complications or setbacks in the purchasing process.

Advantages and Benefits of Buying New Launch Condos with PPS

Buying new launch condos with the Progressive Payment Scheme offers numerous advantages and benefits for buyers.

Let’s explore them in detail:

What are the advantages of buying new launch condos with the Progressive Payment Scheme?

One of the key advantages of buying new launch condos with the Progressive Payment Scheme is that buyers can secure a condo unit at an early stage, which offers potential capital appreciation when the development is completed.

Additionally, the lower initial monthly repayments provide buyers with more disposable income to manage their finances efficiently.

How does the Progressive Payment Scheme benefit buyers in terms of cash flow management?

The Progressive Payment Scheme allows buyers to manage their cash flow more effectively.

Instead of paying the full purchase price in one go, buyers pay several stages of progressive payments as the construction progresses.

This helps in spreading out their financial commitments and ensuring a balanced financial plan.

What are the additional perks available for buyers who opt for the Progressive Payment Scheme?

Buyers who opt for the Progressive Payment Scheme may enjoy additional perks, such as the deferred payment scheme.

This scheme allows buyers to defer a portion of the payment until a later stage, providing more flexibility and easing the financial burden during the earlier stages of homeownership.

The Impact of Progressive Payment Scheme on Resale Condos

What is the Progressive Payment Scheme, and how does it affect resale condos?

The Progressive Payment Scheme is a payment schedule commonly used in the purchase of residential properties, including resale condos.

It is designed to provide flexibility in payment by allowing buyers to make installment payments at different stages of the construction process.

This scheme has significant implications for buyers of resale condos, influencing their financial planning and decision-making.

Understanding the concept of the Progressive Payment Scheme

The Progressive Payment Scheme operates on the principle that payments are made progressively according to the different stages of construction.

Each stage represents a milestone in the completion of the property, and the payment required at each stage is a percentage of the purchase price.

This scheme ensures that buyers do not have to make the full payment upfront but rather pay in portions throughout the construction period.

How the Progressive Payment Scheme impacts the purchase of resale condos

When purchasing a resale condo under the Progressive Payment Scheme, buyers need to be aware of the payment schedule and its impact on their financial obligations.

Unlike purchasing a completed property, where the full payment is typically required upon completion, the Progressive Payment Scheme allows buyers to make payments at various stages of construction.

This means that buyers would pay the developer one installment upon signing the Sales & Purchase Agreement (S&PA), another installment three weeks after the S&PA, and so on, until the property is completed.

Benefits of the Progressive Payment Scheme for resale condo buyers

The Progressive Payment Scheme provides several benefits for buyers of resale condos.

Firstly, it allows buyers to manage their cash flow more effectively as they do not need to make the full payment upfront.

Instead, payments are spread out over an extended period, providing buyers with greater financial flexibility.

Additionally, this scheme enables buyers to start fulfilling their home goals while the property is still under construction rather than waiting for the entire development process to be completed.

How does the payment schedule work for resale condos with Progressive Payment Scheme?

The payment schedule for resale condos under the Progressive Payment Scheme is divided into several stages.

Navigating these stages requires buyers to adhere to specific payment deadlines to avoid any penalties or disruptions in the purchasing process.

Navigating the stages of the payment schedule

The first stage of progressive payment typically involves paying a specific percentage of the purchase price upon signing the S&PA.

The subsequent stages may include payments at specific intervals, such as every three months or upon reaching certain milestones in the construction process.

It is crucial for buyers to stay up-to-date with the payment schedule and fulfill their financial obligations accordingly.

What happens if the buyer fails to make the required payments?

If a buyer fails to make the required payments according to the Progressive Payment Scheme, they may be subject to late payment charges or penalties as specified in the agreement.

The developer has the right to take legal action to recover the outstanding amounts if necessary.

Flexibility in payment schedule for resale condos

While there is a standard payment schedule for resale condos, some developers may offer flexibility in the payment schedule.

This allows buyers to negotiate and customize their payment plans based on their individual financial circumstances.

It is important for buyers to discuss this aspect with the developer or their property agent to explore possible options.

How can Singaporean citizens benefit from the Progressive Payment Scheme?

The Progressive Payment Scheme offers specific benefits to Singaporean citizens looking to purchase resale condos.

Eligibility criteria for Singaporean citizens

Singaporean citizens are eligible to apply for a housing loan from a financial institution to finance their residential property purchase, including resale condos.

This provides them with access to financing options that can be aligned with the Progressive Payment Scheme.

Incentives provided to Singaporean citizens under the scheme

Under the Progressive Payment Scheme, Singaporean citizens may be entitled to various incentives offered by the government.

These incentives can include grants, subsidies, or preferential interest rates on housing loans, aimed at making housing more affordable for citizens.

The availability and specifics of these incentives may vary and are subject to government policies.

Advantages of the Progressive Payment Scheme for local buyers

For local buyers, the Progressive Payment Scheme provides an opportunity to enter the property market even with limited upfront capital.

By utilizing this scheme, local buyers can manage their finances more effectively and plan for their future homeownership goals in a structured manner.

Optimizing the Progressive Payment Scheme for local, mobile, and e-commerce condo buyers

With rapid technological advancements, the Progressive Payment Scheme has witnessed changes over time to cater to the evolving needs of buyers in the digital age.

Technological advancements and their impact on the scheme

The advent of online platforms and mobile applications has revolutionized the way property transactions are conducted.

Buyers now have access to comprehensive property listings, virtual property tours, and online payment facilities.

These technological advancements have made it more convenient for local, mobile, and e-commerce condo buyers to engage in the property purchase process and utilize the Progressive Payment Scheme.

Convenience and accessibility for mobile and e-commerce buyers

Mobile and e-commerce condo buyers can benefit from the convenience and accessibility provided by online platforms.

They can browse through a wide range of resale condos, access detailed information, and even make payments directly through secure online payment gateways.

This simplifies the purchasing process and eliminates geographical constraints, allowing buyers to make informed decisions from anywhere at any time.

Challenges faced by local, mobile, and e-commerce condo buyers

While technological advancements have brought numerous advantages, there are also challenges faced by local, mobile, and e-commerce condo buyers.

These challenges include the need to ensure the security and legitimacy of online transactions, understand the legal implications of the Progressive Payment Scheme, and stay updated with the latest property market trends and regulations.

Understanding the role of Google Analytics in analyzing the effectiveness of the Progressive Payment Scheme

Google Analytics is a powerful tool that can be utilized to analyze the effectiveness of the Progressive Payment Scheme and make data-driven improvements.

Collecting and analyzing data with Google Analytics

With Google Analytics, developers and property agents can collect and analyze data related to the usage and effectiveness of the Progressive Payment Scheme.

This data can include the number of visitors, conversion rates, average time spent on the website, and other key metrics.

Such insights help in identifying areas of improvement and implementing targeted strategies to enhance the scheme.

Identifying key metrics to measure the effectiveness of the scheme

Key metrics to measure the effectiveness of the Progressive Payment Scheme include the number of successful transactions, customer feedback, conversion rates, and customer satisfaction levels.

These metrics provide valuable insights into the performance of the scheme and help in identifying potential areas for optimization.

Improving the Progressive Payment Scheme based on data insights

Data insights obtained through Google Analytics can drive continuous improvement of the Progressive Payment Scheme.

By identifying trends and patterns, developers and property agents can make informed decisions to refine the scheme, streamline processes, and enhance the overall customer experience.

Conclusion

Are you ready to embark on a journey that redefines property ownership? The Progressive Payment Scheme isn’t just a payment schedule; it’s a paradigm shift in how you secure your dream home.

Imagine purchasing a new launch condo with the flexibility to spread payments across construction stages.

It’s not just a financial strategy; it’s a smart investment move.

Picture this: you’re not confined to hefty upfront payments.

Instead, you watch your investment evolve as you make progressive payments linked to construction milestones.

From foundation to rooftop, every installment aligns with progress, giving you financial control and transparency like never before.

As local buyers, you’re empowered by technology, accessing virtual tours, property insights, and secure online transactions.

And with Google Analytics at the helm, developers fine-tune the scheme to ensure your experience is seamless and optimized.

The Progressive Payment Scheme isn’t just about walls and roofs; it’s about securing your future.

Whether you’re a first-time buyer, a tech-savvy mobile seeker, or an astute e-commerce enthusiast, this scheme caters to your needs.

So, embrace the future of property ownership, where flexibility meets investment, and every payment propels you closer to the home of your dreams.

Get ready to rewrite the rules of ownership—your way.

Frequently Asked Questions

Q: What is the progressive payment scheme?

Q: How does the progressive payment scheme work?

These payments are typically calculated as a percentage of the property purchase price.

Q: What happens if the milestones are not reached?

Q: Can I make more than one stage payment in a single month?

Therefore, you cannot make more than one stage payment in a single month.

Q: What happens if I fail to make a stage payment?

Q: When does the legal completion of the property occur?

Q: Can I make the payment in cash?

However, it is advisable to consult with the property developer or bank to understand the preferred mode of payment.

Q: Can the progressive payment scheme be applied to private properties?

Q: What is a monthly installment?

It is calculated based on the loan quantum, interest rate, and time period.