Are you considering buying a Resale HDB flat in Singapore?

If so, there are many factors to consider and important information to know before making your purchase.

In this article, we will provide an in-depth overview of the key aspects of the Resale HDB process.

From eligibility criteria and financing options to government grants and location considerations, we will guide you through each step of the way.

Key Takeaways

- Resale HDB Flats Overview: Resale HDB flats are publicly-owned units sold in the open market, allowing for immediate occupancy. They differ from Built-To-Order (BTO) flats, which require a waiting period for construction.

- Benefits of Resale HDB: Buying a resale HDB flat offers more housing options in mature and non-mature estates. Immediate move-in, better locations, and the opportunity to inspect the flat before purchase are advantages.

- HDB Flat Types: Different flat types cater to various needs. These include 2-room, 3-room, 4-room, and 5-room flats, along with executive flats, studio apartments, and 2-room Flexi flats for singles and elderly buyers.

- 2-Room HDB Flat: Designed for small households or singles, a 2-room flat consists of a bedroom, living area, kitchen, and bathroom, providing affordability and easy maintenance.

- 3-Room HDB Flat: Suitable for small families, a 3-room flat has three bedrooms, a living area, kitchen, and bathroom. Eligible buyers include Singapore citizens, permanent residents, and non-Malaysian foreigners with a family nucleus.

- Resale HDB Eligibility: Eligibility for resale HDB purchase extends to Singapore citizens, permanent residents, and non-Malaysian foreigners, with specific criteria based on citizenship status.

- Non-Singaporean Buyers: Non-Singaporean buyers must meet additional eligibility requirements, including obtaining approval from the Controller of Residential Property and paying an Additional Buyer’s Stamp Duty (ABSD).

- Benefits for Singaporean Citizens: Singaporean citizens enjoy benefits like housing grants, access to a range of loan options, and favorable interest rates when purchasing a resale HDB flat.

- Singaporean Citizens’ Considerations: Location, amenities, lease duration, appreciation potential, and financial capabilities are factors to consider for Singaporean citizens when buying a resale HDB flat.

- CPF Housing Grant: The CPF Housing Grant offers subsidies to eligible Singaporean citizens purchasing a resale HDB flat, helping offset the purchase price or mortgage loan.

Understanding Resale HDB: Exploring the Basics of Resale HDB Flats

What is a resale HDB flat?

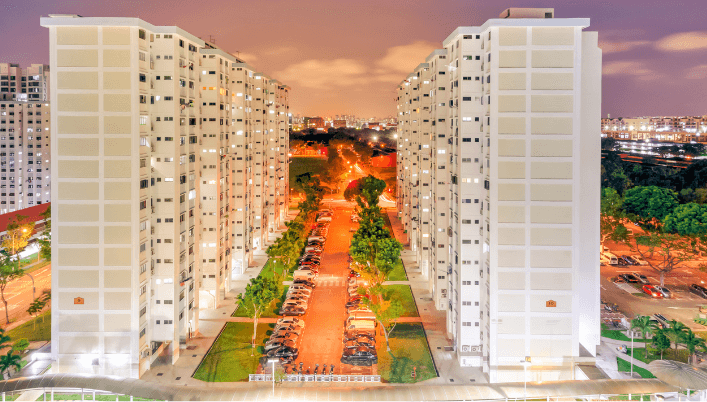

A resale HDB flat is a public housing unit that is sold by its existing owner in the open market instead of being offered through the Built-To-Order (BTO) exercise.

These flats are usually located in mature estates and are available for immediate occupancy upon purchase.

How is a resale HDB different from a BTO flat?

A BTO (Built-To-Order) flat is a new HDB flat directly purchased from the government in a non-mature estate.

On the other hand, a resale HDB flat is a pre-owned unit sold in the open market.

The key difference is that you can move into a resale flat immediately, whereas BTO flats require a waiting period for construction.

What are the benefits of purchasing a resale HDB flat?

Buying a resale HDB flat comes with several advantages.

Firstly, you have more housing options to choose from, as resale flats are located in both mature and non-mature estates.

Secondly, you can move in immediately after completing the purchase, saving you the waiting time associated with BTO flats.

Additionally, resale flats often come with better locations and established amenities.

Lastly, as a buyer, you have the opportunity to inspect the flat before purchase, ensuring that it meets your requirements.

Types of HDB Flats: A Detailed Look at Different Flat Types Available

What are the different types of HDB flats available?

HDB offers various flat types to cater to the diverse needs of its residents.

The most common types include 2-room, 3-room, 4-room, and 5-room flats.

Additionally, there are larger executive flats, studio apartments for elderly residents, and 2-room Flexi flats for singles and elderly buyers.

What are the features and characteristics of a 2-room HDB flat?

A 2-room HDB flat is designed for small households or singles.

It typically consists of a bedroom, a living area, a kitchen, and a bathroom.

The compact size makes it affordable and easier to maintain.

What is a 3-room HDB flat and who is eligible to purchase it?

A 3-room HDB flat is suitable for small families.

It consists of three bedrooms, a living area, a kitchen, and a bathroom.

Eligible buyers for a 3-room flat include Singapore citizens, Singapore permanent residents, and non-Malaysian foreigners with a family nucleus.

Eligibility Criteria for Resale HDB: Who Can Purchase a Resale HDB Flat?

Who is eligible to buy a resale HDB flat?

To be eligible to purchase a resale HDB flat, you need to meet certain criteria.

The eligibility extends to Singapore citizens, Singapore permanent residents, and non-Malaysian foreigners.

However, some restrictions apply depending on your citizenship status.

What is the income ceiling for purchasing a resale HDB flat?

The income ceiling for buying a resale HDB flat varies based on your household status.

For example, the income ceiling for families is higher compared to singles.

It is important to check the latest income ceiling guidelines provided by HDB to determine your eligibility.

What happens if the buyer is a non-Singaporean?

If the buyer is a non-Singaporean, there are additional eligibility requirements that need to be met.

Non-Malaysian foreigners must obtain the approval of the Controller of Residential Property and pay an Additional Buyer’s Stamp Duty (ABSD) when purchasing a resale HDB flat.

Singaporean Citizens and Resale HDB: Benefits and Considerations

What are the benefits of being a Singaporean citizen when buying a resale HDB flat?

As a Singaporean citizen, you enjoy several benefits when purchasing a resale HDB flat.

Firstly, you are eligible for various housing grants provided by the government, such as the CPF Housing Grant, which can help to offset the purchase costs.

Secondly, you have access to a wider range of HDB loan options and favorable interest rates.

Are there any specific considerations for Singaporean citizens when purchasing a resale HDB flat?

When purchasing a resale HDB flat, Singaporean citizens should consider factors such as the location, amenities, lease duration, and potential for appreciation.

Additionally, they should factor in their financial capabilities, such as the affordability of the resale flat and the loan repayment terms.

What is the CPF Housing Grant and how does it apply to Singaporean citizens buying a resale HDB flat?

The CPF Housing Grant is a subsidy provided by the government to eligible Singaporean citizens buying a resale HDB flat.

The grant amount is based on the buyer’s income and housing needs.

It can be used to offset the purchase price or reduce the mortgage loan required.

Single Singaporeans and Housing Options: Exploring the Joint Singles Scheme

What is the Joint Singles Scheme and how does it benefit single Singaporeans?

The Joint Singles Scheme is designed to provide housing options for single Singaporeans aged 35 years old and above.

Under this scheme, single Singaporeans can form a group of up to four individuals to jointly purchase a 4-room or larger resale flat.

This allows them to enjoy the benefits of homeownership and share the expenses.

Who is eligible for the Joint Singles Scheme?

Single Singaporeans who are at least 35 years old, Singapore citizens, and have no existing housing ownership are eligible for the Joint Singles Scheme.

They can form a group with other eligible singles and jointly purchase a resale flat.

What are the different flat types available under the Joint Singles Scheme?

Under the Joint Singles Scheme, eligible singles can purchase a 4-room or larger resale flat.

This provides them with ample space and the opportunity to create a comfortable living environment.

The Single Singapore Citizen Scheme: An In-Depth Overview

Understanding the eligibility criteria

One of the popular HDB schemes available for resale flats is the Single Singapore Citizen Scheme.

This scheme allows single individuals who are Singapore citizens to purchase a resale flat.

However, there are certain eligibility criteria that need to be fulfilled in order to qualify for the scheme.

Benefits and advantages of the scheme

The Single Singapore Citizen Scheme offers several benefits and advantages to eligible individuals.

Some of these include the ability to purchase a flat in a non-mature estate, access to a wider range of flat options, and the possibility to buy a larger flat compared to HDB BTO flats.

Furthermore, singles under this scheme may also apply for housing grants, depending on their circumstances.

Application process and documentation required

When applying for the Single Singapore Citizen Scheme, there are specific documents required to prove eligibility.

These may include identity documents, income proof, and other supporting documents.

It is important to familiarize yourself with the application process and gather all necessary documentation before proceeding with your resale flat purchase.

Financing Your Resale HDB: Exploring Housing Loan and Mortgage Options

Bank loan vs. housing loan: Which one is right for you?

When it comes to financing your resale HDB flat, you have the option to choose between a bank loan or a housing loan offered by HDB.

Each option has its own advantages and factors to consider.

It is essential to evaluate your financial situation and preferences to determine which loan option is the most suitable for your needs.

Factors to consider when choosing a loan package

Choosing the right loan package is crucial to ensure that you can afford the monthly mortgage payments and repay the loan comfortably.

Factors to consider when making this decision include interest rates, loan tenures, and the total amount of loan you will be taking.

It is advisable to consult with financial institutions and seek professional advice to make an informed choice.

Understanding the valuation process and how it affects your loan amount

During the financing process for your resale HDB flat, a valuation will be conducted to determine the market value of the property.

This valuation directly affects the loan amount you can borrow.

It is important to understand how the valuation process works and how it may impact your loan approval and the overall cost of your flat purchase.

Government Grants for Resale HDB: Maximizing Benefits for Buyers

An overview of the available grants and their eligibility requirements

The Singapore government offers various grants to support buyers in purchasing resale HDB flats.

These grants include the Enhanced CPF Housing Grant, the Proximity Housing Grant, and the Family Grant, among others.

Understanding the eligibility requirements and the amount of grant you can potentially receive is crucial in maximizing the benefits of government assistance in your resale flat purchase.

How to apply for government grants during the resale process

Applying for government grants during the resale process requires completing the necessary application forms and providing the required documentation.

The process may vary depending on the specific grant you are applying for.

It is advisable to seek guidance from HDB or consult with a property agent who can assist you in navigating through the application process.

Tips on maximizing the benefits of government grants

In order to maximize the benefits of government grants, it is important to plan ahead and understand the eligibility criteria and terms of each grant.

Additionally, exploring different options such as the Enhanced CPF Housing Grant and the Proximity Housing Grant can provide additional financial assistance and incentives to eligible buyers.

Location Matters: Exploring Resale Flats in Different Estates

An overview of popular estates for resale HDB

When it comes to choosing a location for your resale HDB flat, there are several popular estates to consider.

Some of these include Bukit Merah, Bukit Batok, Punggol, Bishan, Choa Chu Kang, Bukit Panjang, Jurong West, and Pasir Ris, just to name a few.

Each estate has its own unique characteristics and advantages, such as proximity to amenities, transportation, and community facilities.

Factors to consider when choosing a location for your resale flat

Choosing the right location for your resale flat is crucial as it can greatly impact your daily life and convenience.

Factors to consider include proximity to your workplace, the availability of schools and educational institutions, accessibility to public transportation, and the overall livability and lifestyle offered by the estate.

Understanding the resale market trends in different estates

Resale market trends can vary across different estates in Singapore.

It is important to stay updated with the latest news and statistics to understand the price fluctuations and demand in each respective estate.

This information can help you make an informed decision and potentially identify undervalued properties in certain estates.

The Resale Process: Step-by-Step Guide to Purchasing a Resale HDB Flat

Step 1: Searching for resale listings and engaging a property agent

The first step in the resale process is searching for resale listings on online portals and engaging the services of a property agent.

A property agent can assist you in finding suitable resale flats that meet your criteria and requirements.

They can also guide you through the entire process and provide valuable advice.

Step 2: Applying for an option fee and making an offer

Once you have identified a resale flat that you are interested in, you will need to apply for an option fee and make an offer to the seller.

The option fee is a sum of money that secures your interest in the flat for a specific period of time.

During this period, you can conduct inspections and negotiations with the seller.

Step 3: Completing the resale application and submitting required documents

After both parties have agreed on the terms and conditions of the resale, the next step is completing the resale application and submitting the required documents to HDB.

This includes the necessary forms, supporting documents, and payment of HDB-related fees.

It is crucial to ensure accuracy and completeness to expedite the processing of your resale transaction.

Property Valuation and Pricing: Understanding Resale Flat Prices

When considering buying a resale HDB flat, one of the first things you need to understand is property valuation and pricing.

Estimating the resale flat prices can give you a clearer idea of what to expect and how much you should budget for.

Several factors affect the resale flat prices, including location, amenities, proximity to public transportation, and the overall condition of the flat.

Estimating Resale Flat Prices

Estimating resale flat prices can be challenging, but by analyzing the median resale prices of similar flats in the desired location, you can get a rough estimate.

Various online platforms and the HDB resale portal provide data on the prices for resale flats in different areas.

Factors Affecting Resale Flat Prices

As mentioned earlier, several factors can influence resale flat prices.

Some of the common factors include the location of the flat, its proximity to amenities like schools and shopping centers, and accessibility to public transportation.

The overall condition of the flat, such as its age, renovations, and maintenance, can also impact the resale price.

Analyzing Median Resale Prices

Analyzing the median resale prices in your desired location can give you a benchmark to compare against.

It can help you gauge whether the asking price for a particular resale unit is reasonable or overpriced.

By researching and keeping track of the market trends, you can make a more informed decision.

The Role of Property Agents in Resale HDB Transactions

Property agents play a crucial role in resale HDB transactions, making the whole process smoother and more efficient.

Understanding their role and how they can assist you can be beneficial when it comes to buying your resale flat.

Understanding the Role of a Property Agent

A property agent acts as a mediator between the buyer and the seller.

They are responsible for guiding you through the entire process and ensuring that all necessary documentation and procedures are followed.

Their expertise in the local property market can provide valuable insights to help you make informed decisions.

How Property Agents Help in Resale HDB Transactions

Property agents can help you in several ways during the resale HDB transaction.

They can assist in property search, arrange viewings, negotiate the price, and handle the necessary paperwork.

They can also provide valuable advice on market trends, financing options, and help you navigate any challenges that may arise.

Choosing the Right Property Agent

Choosing the right property agent is crucial for a successful resale HDB transaction.

Look for agents who have experience in dealing with HDB resale flats and a good track record.

Consider their knowledge of the local market, communication skills, and professionalism when making your decision.

Renovation and Miscellaneous Costs: Budgeting for Your Resale HDB Journey

Buying a resale HDB flat involves not only the purchase price but also additional costs like renovation and miscellaneous expenses.

Proper budgeting is essential to ensure you are financially prepared for the entire journey.

Estimating Renovation Costs

Renovation costs can vary significantly depending on the size of the flat, the extent of renovations required, and your personal preferences.

It is advisable to obtain quotes from multiple contractors and factor in any additional costs for materials and furnishing.

Additional Miscellaneous Costs to Consider

Aside from renovation costs, there are various other miscellaneous expenses to consider.

These include legal fees, stamp duties, home insurance, and any fees related to the loan application or valuation of the flat.

It is important to account for these costs to avoid any financial surprises later on.

Creating a Budget for Your Resale HDB

Creating a budget for your resale HDB journey is crucial for proper financial planning.

Consider your monthly income, existing debts, and any savings you may have.

Ensure that you have a clear understanding of your financial capabilities and set a realistic budget for your property purchase.

Resale HDB Market Trends: Analyzing Statistics and Median Prices

Staying informed about the resale HDB market trends can help you make informed decisions and avoid overpaying for a resale flat.

Analyzing statistics and median prices can provide valuable insights into the current state of the market.

Understanding Resale Market Trends

The resale HDB market is influenced by various factors such as government policies, economic conditions, and supply and demand.

By understanding these trends, you can assess whether it is a favorable time to enter the market or wait for better opportunities.

Analyzing Resale Statistics and Flash Estimates

Resale statistics and flash estimates are valuable sources of information when analyzing the market.

They provide data on transaction volumes, average prices, and other relevant market indicators.

Keeping track of these statistics can help you make more informed decisions.

Factors Influencing Resale HDB Prices

The resale HDB prices can be influenced by several factors such as location, amenities, market demand, and government regulations.

Understanding these factors can help you assess the potential for price appreciation and make a more informed buying decision.

BTO vs. Resale HDB: Choosing the Right Option for Your Housing Needs

When it comes to buying a HDB flat, you have the option of choosing between Built-To-Order (BTO) flats or resale HDB flats.

Each option has its pros and cons, and it is essential to consider your specific housing needs before making a decision.

Understanding the Difference Between BTO and Resale HDB

BTO flats are brand new flats offered by HDB, while resale HDB flats are previously owned flats.

BTO flats are usually sold at a lower price, but they require a longer waiting time for the completion of the construction.

Resale HDB flats, on the other hand, offer more flexibility in terms of location and immediate availability.

Pros and Cons of Buying a Resale HDB

Buying a resale HDB has its advantages and disadvantages.

One of the main advantages is the immediate availability of the flat, allowing you to move in without a long waiting time.

Resale flats are also located in established neighborhoods with existing amenities.

However, they may require renovation and have a higher upfront cost compared to BTO flats.

Factors to Consider When Choosing Between BTO and Resale HDB

When choosing between BTO and resale HDB, it is essential to consider factors such as budget, location preference, and immediate housing needs.

If you require a flat immediately and prefer a specific location, resale HDB may be the better option.

However, if you are willing to wait and prioritize affordability, a BTO flat might be more suitable.

Conclusion

Embark on a journey into the dynamic world of Resale HDB flats – a realm of possibilities awaiting your exploration! Imagine owning a piece of Singapore’s vibrant landscape, a place you can call home.

Unveil the secrets of Resale HDB, the pathway to a unique housing experience.

Dive into the heart of this captivating domain, where history and modernity intertwine.

Discover the essence of a Resale HDB flat – a treasure sold by its owner, offering you the keys to immediate comfort and convenience.

Contrast it with the allure of BTO flats, revealing the choices that shape your dreams.

Delve deeper into the myriad benefits of acquiring a Resale HDB.

Engage in a symphony of options, from mature estates to the unexplored, where every corner is rich with potential.

Embrace the luxury of instant gratification as you unlock your new abode, a canvas ready for your personal touch.

Step into the shoes of a property agent, your guide through the labyrinth of transactions.

Witness their expertise in action, bridging the gap between dreams and reality.

Revel in the power of knowledge as you decipher property trends, shaping your journey with insight and foresight.

But that’s not all – the adventure continues as you navigate the intricate dance of finance.

Uncover the mysteries of valuation, pricing, and loans, ensuring your every step is measured and secure.

Empower yourself with the wisdom to make choices that resonate with your aspirations.

As you forge ahead, embrace the allure of location, where neighborhoods beckon with their unique charm.

Experience the pulse of each area, from bustling cityscapes to serene enclaves, and make a decision that mirrors your desires.

Take the leap into a world where housing dreams come alive.

With every decision you make, the tapestry of your journey weaves together, creating a masterpiece of comfort, belonging, and the promise of a brighter future.

Your Resale HDB adventure awaits – are you ready to seize the keys to your new life?

Frequently Asked Questions

What is resale HDB?

Resale HDB refers to the purchase of a Housing and Development Board (HDB) flat from its current owner, instead of applying for a new flat directly from HDB.

What is the difference between HDB resale flat and a private property?

The main difference between an HDB resale flat and a private property is that HDB flats are subsidized by the government and are meant for public housing, while private properties are owned by individuals and are usually more expensive.

Can singles buy HDB resale flats?

Yes, singles are eligible to buy HDB resale flats.

However, there are certain eligibility criteria and schemes available specifically for singles looking to purchase a resale flat.

What is an executive condominium?

An executive condominium (EC) is a type of housing in Singapore that is similar to a private condominium.

ECs are developed and sold by private developers, but have certain eligibility criteria and restrictions set by the government.

Are there grants available for singles buying a resale HDB flat?

Yes, there are grants available for singles buying a resale HDB flat.

These grants are aimed at making housing more affordable for singles and can help to offset the cost of purchasing a resale flat.

What is the difference between a BTO and resale flat?

BTO stands for Build-To-Order and refers to new HDB flats that are sold directly from HDB.

Resale flats, on the other hand, are HDB flats that are being sold by their current owners.

The main difference is that BTO flats are brand new and have not been previously owned.

What are the available HDB flat options for singles?

Singles have the option to buy a 2-room flexi BTO flat or a resale flat.

The 2-room flexi BTO flat is a smaller unit specifically designed for singles or couples without children.

How long is the lease period for HDB flats?

Most HDB flats have a lease period of either 99 years or 999 years.

However, there are also some HDB flats with shorter lease periods, such as 45 years.

Can I buy a resale HDB flat if I already own another property?

If you already own another property, you are not eligible to buy a resale HDB flat.

HDB resale flats are meant for first-time buyers or those who do not own any other property.

What is the Option Exercise Fee for buying a resale HDB flat?

The Option Exercise Fee is a fee paid by the buyer to the seller during the resale flat transaction.

It is usually 1% of the agreed purchase price and is paid when the buyer exercises the option to purchase the flat.