What is the HDB Conversion Scheme?

The HDB Conversion Scheme is a program offered by the Housing and Development Board (HDB) in Singapore that allows homeowners to convert their existing HDB flats into larger flats.

This scheme is especially beneficial for families who have outgrown their current living space and need more room.

Definition of the HDB Conversion Scheme

The HDB Conversion Scheme allows homeowners to combine two adjacent HDB flats into one jumbo flat.

By doing so, they can enjoy a bigger living space and more rooms for their growing family.

Homeowners who choose to participate in this scheme can also enjoy a higher loan quantum for their new flat, as well as various housing grants and subsidies.

History of the HDB Conversion Scheme

With the rise in property prices and the limited supply of larger flats, the HDB saw the need to provide a solution for families who needed more space.

The pilot scheme was launched in 2003 in Woodlands, where jumbo flats were created by combining two adjoining units.

The program was later expanded to other areas in Singapore.

https://www.youtube.com/watch?v=UL1xMpX7Zh8

Key Features of the HDB Conversion Scheme and its benefits

The HDB Conversion Scheme offers several benefits for homeowners.

First, it allows families to remain in their current neighborhood, avoiding the need to uproot and move to a new area.

It also provides more living space, which is essential for larger families or those with multi-generational households.

The scheme offers various housing loan options to help homeowners finance the purchase of their new jumbo flat.

Financial considerations such as loan eligibility and affordability are taken into account during the resale application process.

Homes participating in the scheme also have the option to cover both flats under the same housing loan, streamlining the financial commitment for homeowners.

The HDB Conversion Scheme is available in both mature and non-mature estates in Singapore.

This ensures that homeowners have the flexibility to choose their preferred location.

The scheme also allows joint singles, individuals who are unmarried or divorced, to participate, broadening the eligibility criteria for potential participants.

In summary, the HDB Conversion Scheme is a popular option for homeowners in Singapore who are looking to increase their living space without having to move to a new area.

With its flexibility, financial support, and benefits for larger families, it has become a sought-after program within the HDB housing landscape.

Key Takeaways

- Definition of HDB Conversion Scheme

- The HDB Conversion Scheme allows homeowners to merge two adjacent HDB flats into a larger jumbo flat.

- It’s beneficial for families outgrowing their current space, providing more rooms and a bigger living area.

- History and Introduction

- Introduced in 2003 in Woodlands, the scheme addresses the demand for larger flats due to rising property prices.

- Initially a pilot program, it expanded to various areas in Singapore.

- Key Features and Benefits

- Offers benefits like staying in the same neighborhood, more living space, higher loan quantum, and housing grants.

- Eligible for both mature and non-mature estates, including joint singles.

- Popular Option for Families

- Ideal for families wanting more living space without relocating.

- Flexible, financially supportive, and caters to larger families.

- Financial Considerations and Housing Loan Options

- Financial aspects, including loan eligibility and affordability, are considered during resale application.

- Flexibility in covering both flats under the same housing loan.

- Overview of the Scheme’s Scope

- Available for mature and non-mature estates, ensuring flexibility in location.

- Involves local, mobile, and e-commerce SEO strategies for optimal visibility.

- Strategic Use of Google Analytics

- Emphasizes the interpretation of data and analysis of user behavior for valuable insights.

- Utilized to guide clients and empower them with SEO knowledge and tools.

- Conducting SEO Audits

- Involves assessing strengths, weaknesses, potential improvements, and long-term success traits.

- Empowers clients for excellence in the dynamic SEO landscape.

- Expertise in Jumbo Flats in Singapore

- Jumbo flats created by merging two HDB units offer more living space and unique benefits.

- Popularity driven by affordability, accessibility to loans, and diverse location options.

- Step-by-Step Process of HDB Conversion Scheme

- Eligibility criteria include ownership of both flats, side-by-side location, and meeting the Minimum Occupation Period.

- Involves submitting an application, obtaining HDB approval, addressing financial considerations, and executing the conversion.

Understanding Jumbo Flats in Singapore | Two Units

Exploring the concept of Jumbo Flats in Singapore

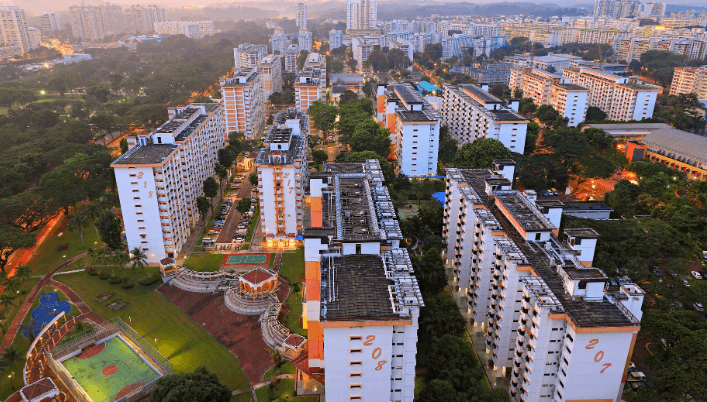

Jumbo flats are a unique and sought-after type of residential property in Singapore.

They are created by combining two adjacent HDB units, resulting in a larger living space for families.

Unlike regular HDB flats, jumbo flats offer extra space and are ideal for larger families or those who value the benefits of extended family bonding.

While jumbo flats are rare, they can be found in various locations across Singapore.

These flats may be sold in the resale market and are subject to the same housing grants and eligibility conditions as regular HDB units.

The sheer size of jumbo flats makes them an attractive option for families looking for more living space.

They provide the opportunity for each family member to have their own room, allowing for privacy and individuality.

This is especially beneficial for families with older children or multi-generational households.

Advantages and popularity of Jumbo Flats in the HDB housing market

Jumbo flats have gained popularity in the HDB housing market due to several advantages they offer.

Firstly, jumbo flats provide a wide range of affordable options for families who require more living space.

Instead of purchasing multiple smaller flats, combining two units into a jumbo flat offers a cost-effective solution.

Financial institutions in Singapore are more willing to grant loans for jumbo flats, making them accessible to potential buyers.

Additionally, jumbo flats are not restricted to specific locations.

They can be found in various estates such as Woodlands and Yishun.

To be eligible for a jumbo flat, applicants must form a family nucleus and meet the income ceiling.

The eligibility conditions are the same as those for regular HDB flats.

Seeking advice from a real estate agent or a trusted advisor can help navigate the process.

Jumbo flats also come with practical advantages, such as a wider range of renovations and customization options.

The larger space allows for more creative designs and renovations, giving families the opportunity to create a home that suits their needs and preferences.

Furthermore, jumbo flats often come with gas supply, which is rare in 3-room flats or smaller units.

This allows residents to enjoy the benefits of gas-powered appliances and cooking.

Jumbo flats in Singapore provide an excellent solution for families in need of more space.

They offer advantages such as affordability, customization options, and the opportunity for strong family bonding.

With their growing popularity in the HDB housing market, jumbo flats are a viable and attractive option for families looking to upgrade their living arrangements.

Grants and HDB housing loans provide essential financial aid to individuals and families in need of affordable housing.

These grants assist in alleviating the burden of purchasing a home and making it more accessible to those with lower incomes.

Additionally, the option to sell a converted flat presents an opportunity for homeowners to unlock their property’s value and potentially upgrade to a larger or more desired living space.

Conversely, buying an adjoining flat allows homeowners to expand their current living quarters by combining two separate units into one.

This option proves especially beneficial for families looking for more space or for those who frequently have guests staying over.

Jumbo flats in Woodlands cater to the needs of larger families by offering spacious living areas and multiple bedrooms.

This type of housing can accommodate extended family members or provide additional rental income.

Furthermore, the jumbo flat concept allows for the consolidation of one unit number, creating a cohesive living space for multiple households.

Another option for families is the 3Gen flats, which enable multi-generational living under one roof.

This design promotes closer family ties and shared responsibilities while still providing privacy for each member.

Finally, for those who desire to stay in close proximity to their current residence, the option to buy a flat next to their existing one proves advantageous.

This allows for greater convenience and familiarity with the neighborhood, while also providing an opportunity for expansion or investment purposes.

How Does the HDB Conversion Scheme Work?

Step-by-step process of the HDB Conversion Scheme

The HDB Conversion Scheme is a program in Singapore that allows HDB owners to combine two adjoining flats into a single unit, providing more space for the homeowners.

Here is a step-by-step guide to understanding how the scheme works:

- Eligibility: To be eligible for the HDB Conversion Scheme, the homeowners must meet certain criteria set by the Housing and Development Board (HDB). This includes being the owner of both flats, the flats must be side by side, and the homeowners must have fulfilled the Minimum Occupation Period (MOP) for both flats.

- Submit Application: The first step is to submit an application to HDB to request permission for the conversion. The application will require details such as the addresses of both flats, floor plans, and other necessary documentation.

- HDB Approval: HDB will review the application and assess if the conversion is feasible and meets the necessary requirements. If approved, the homeowners will receive a letter of approval from HDB.

- Financial Considerations: The homeowners need to consider the financial aspects of the conversion. This includes assessing the cost of the conversion, any loan requirements, and potential changes in their financial commitments.

- Execute Conversion: After obtaining HDB’s approval and arranging for the necessary financial arrangements, the homeowners can proceed with the conversion. This may involve engaging contractors and professionals to carry out the renovation work.

- Inspection and Renovation Completion: Once the conversion is completed, the homeowners must arrange for an inspection by HDB to ensure that the conversion has been done according to their guidelines. After the inspection, they can proceed to move into their new, combined unit.

Financial considerations and housing loan options for buying a Jumbo Flat

Buying a Jumbo Flat through the HDB Conversion Scheme involves various financial considerations.

Here are some key points to keep in mind:

- Housing Loan Options: Homeowners can consider taking a housing loan from financial institutions or using their existing home loan for the purchase of the Jumbo Flat.

- Rental Income: Jumbo Flats are popular among multi-generational families as they offer ample space. Homeowners could explore the option of renting out a portion of the flat for rental income.

- Financial Commitment: It’s important to assess one’s financial capabilities and ensure that purchasing a Jumbo Flat is a viable option without compromising financial stability.

- Additional Options: Homeowners can also consult with a qualified real estate professional to explore additional financing options, such as bank loans, that may be available for the purchase of a Jumbo Flat.

The HDB Conversion Scheme provides an opportunity for homeowners in Singapore to create a more spacious and comfortable living environment.

By understanding the step-by-step process and considering the financial aspects, homeowners can make informed decisions about converting their current units into a Jumbo Flat.

Buying a Jumbo Flat under the HDB Conversion Scheme

Are you a growing family in Singapore looking for a spacious home that meets your needs?

The HDB Conversion Scheme allows you to purchase a jumbo flat, providing ample space for your family.

Here is all you need to know about the procedure and factors to consider when buying a jumbo flat through this scheme.

Procedure for buying a Jumbo Flat through the HDB Conversion Scheme

To buy a jumbo flat under the HDB Conversion Scheme, you need to follow these steps:

- Research the resale market: Understand the current prices and trends in the resale jumbo flat market to make an informed decision.

- Check eligibility requirements: Ensure that you are eligible to buy a jumbo flat under the HDB Conversion Scheme. This includes being an eligible buyer, having a certain household income, and meeting other criteria.

- Find suitable jumbo flats: Search for jumbo flats in the resale market that meet your criteria, such as the desired location, square footage, and number of rooms.

- Finance considerations: Assess your financial capabilities, including how much housing loan you can secure from financial institutions and the actual price you can afford.

- Visit the selected jumbo flats: Personally inspect the shortlisted units to ensure they meet your needs and have nearby amenities that suit your lifestyle.

- Engage the services of an agent: Consider engaging a professional agent who can assist you with the buying process, negotiate the best deal, and guide you with any legal requirements. Keep in mind there may be agent fees involved.

- Seek professional advice: Consult a finance advisor for advice on housing loans, current market trends, and other financial considerations.

Factors to consider when purchasing a Jumbo Flat in Singapore

When purchasing a jumbo flat through the HDB Conversion Scheme, consider the following factors:

- Location: Choose a location that is convenient and suits your lifestyle, with access to amenities like shopping centers, schools, and transportation.

- Square footage: Assess the floor size of the jumbo flat and consider whether it provides enough space for your family’s needs.

- Financial considerations: Ensure that the housing loan and other financial commitments are manageable.

- Professional advice: Seek guidance from finance advisors and professionals who can provide expert advice.

By following these steps and considering these factors, you can smoothly navigate the process of purchasing a jumbo flat under the HDB Conversion Scheme and find a spacious home that meets your needs in Singapore.

https://www.youtube.com/watch?v=ZdkCl1eDWKQ

When considering the purchase of a resale HDB flat, one option to explore is buying the adjoining unit.

This entails buying the flat adjacent to the one you initially intended to purchase.

By doing so, you can create a larger living space by combining the two units.

This may be particularly appealing for those planning to start or expand their families or those who desire a larger living area.

However, it is crucial to note that not all HDB flats are eligible for this option.

Only standard HDB flats, which typically measure around 1 metre by 2 metres, can be combined.

Additionally, the unit number of the adjoining flat must be within a certain range specified by HDB.

It is also important to consider the various HDB flat types available, such as 2-room, 3-room, 4-room, and 5-room flats, as the possibility of purchasing an adjoining flat may vary depending on the specific type.

Furthermore, it is advisable to research and understand the housing grants that are available for resale flats, as this may help offset the cost of buying the adjoining unit.

Ultimately, buying the adjoining HDB flat can offer significant advantages in terms of space and future flexibility, but careful consideration and planning are necessary to ensure eligibility and feasibility.

Rare Opportunities: Finding Two Adjoining HDB Flats | Type of HDB

Exploring the rarity of two adjoining HDB flats

Finding two adjoining HDB flats in Singapore’s resale market is a rare and exciting opportunity.

With various flat types available, such as resale jumbo flats, potential buyers have the chance to buy not just one, but two flats that are connected.

This opens up new possibilities for extended families or those looking for extra space.

The demand for adjoining flats is driven by larger families or those with specific needs that require more residential properties.

However, the availability of flats suitable for conversion into an adjoining unit is limited.

The biggest 5-room flats or jumbo flats are usually the best options for this purpose.

The Housing and Development Board (HDB) ensures the availability of flats for different needs, but finding two adjoining flats may still be a challenge due to the sheer size and demand for these units.

Therefore, it is important to keep an eye out for listings and act quickly when such opportunities arise.

Benefits and considerations of purchasing two adjoining HDB flats

Buying two adjoining HDB flats brings several benefits, but it also requires careful considerations.

By combining two flats into a single unit, buyers can enjoy more living space and flexibility in design.

This is especially advantageous for larger families or those seeking more affordable living options.

Before proceeding with the purchase, it is essential to check the eligibility conditions set by the HDB.

The income ceiling for buying a 4-room flat applies to each individual flat, and some practical considerations, such as gas supply and availability of space, need to be addressed.

Employing the services of a real estate agent experienced in such transactions can provide valuable advice and guidance.

It’s important to note that purchasing two adjoining HDB flats is not limited to Singapore citizens.

Singapore Permanent Residents are also eligible, enhancing the accessibility of these rare opportunities.

With the wider range of layouts, flat configurations, and average occupancy sizes in two adjoining flats, a bit of space planning may be required to make the most out of the combined space.

However, the average size of the two flats can result in a substantial increase in living area, making it an appealing option for those seeking more spacious living arrangements.

In conclusion, finding two adjoining HDB flats presents a rare opportunity in Singapore’s resale market.

The benefits of purchasing such flats include increased living space and affordability, but careful considerations and adhering to eligibility conditions are essential.

With proper planning and guidance, buyers can leverage these opportunities to create a comfortable and functional living environment for their families.

Financing Your Jumbo Flat: Housing Loan Options

If you’re considering purchasing a Jumbo Flat in Singapore, it’s essential to understand the housing loan options available to you.

Jumbo Flats are larger than traditional HDB flats, with floor sizes ranging from 1,500 sqft and above.

These spacious flats are ideal for multi-generational families or those looking to generate rental income.

When it comes to financing your Jumbo Flat, you have a few options to consider.

The most common option is to apply for a new loan for the purchase of your Jumbo Flat.

This loan will be similar to a standard housing loan, and you can approach various financial institutions to explore their loan packages.

Another option is to utilize the current flat you own as collateral and take out a bank loan against it.

This can be a viable option if you have ample equity in your current unit and are looking for additional financing options.

It’s important to note that Jumbo Flats are typically found in non-mature estates.

As such, financial institutions might have specific criteria or restrictions when it comes to offering loans for these properties.

It’s advisable to consult with a real estate professional or a financial advisor to understand the specific requirements and options available to you.

When considering financing options for your Jumbo Flat, it’s crucial to plan your financial commitment carefully.

Jumbo Flats come with a higher price tag compared to traditional HDB flats, so understanding your budget and financial capabilities is essential.

In summary, if you’re looking to purchase a Jumbo Flat in Singapore, there are several housing loan options available to you.

Whether it’s applying for a new loan, utilizing your current flat as collateral, or exploring additional options, it’s important to do your research and seek advice from professionals in the field.

By understanding your financial commitments and exploring viable loan options, you can make an informed decision when financing your Jumbo Flat.

Conclusion

The HDB Conversion Scheme is a great option for homeowners in Singapore who are looking to maximize their living space.

By converting adjacent flats into a single unit, homeowners can enjoy the benefits of a larger living space without having to move.

This scheme is available for various housing types, including executive flats, giant flats, and unsold flats.

The process involves filling out an application form and obtaining approval from the relevant authorities.

It is important to note that not all flats are eligible for conversion, and there are certain considerations to take into account, such as outstanding housing loans and the availability of adjacent units.

To apply for the HDB Conversion Scheme, homeowners need to fill out an application form, which can be obtained from the HDB website or the relevant HDB branches.

The form requires information such as the flat address, the desired flat units to be converted, and the reasons for the conversion.

Once the application is submitted, it will be reviewed by the HDB, and if approved, the homeowner will be notified of the next steps.

It is important to note that the approval process can take several months, so homeowners should plan accordingly.

The HDB Conversion Scheme offers homeowners the opportunity to create a larger living space to accommodate their growing needs.

By converting adjacent flats, homeowners can enjoy plenty of space and the flexibility to design their home according to their preferences.

This scheme is particularly attractive for families with larger household sizes, as it provides a cost-effective alternative to private housing.

However, it is important to consider factors such as outstanding housing loans and the availability of adjacent units before applying for the scheme.

Homeowners should also carefully consider their long-term housing needs and financial capabilities before making a decision.

In conclusion, the HDB Conversion Scheme is a valuable option for homeowners in Singapore who are looking to optimize their living space.

By understanding the application process and considering the benefits and considerations, homeowners can make an informed decision about whether this scheme is the right choice for them.